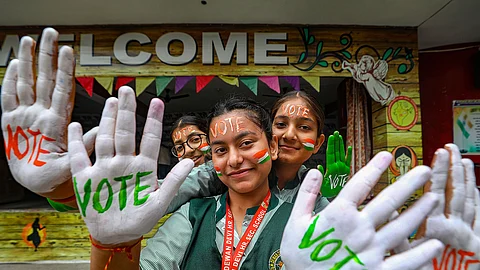

LS polls Phase 2: Rahul Gandhi, Shashi Tharoor in fray; Hema Malini, Om Birla seek hat-trick of wins

In the second phase of the Lok Sabha polls on Friday, polling is scheduled for a total of 89 seats spanning across Kerala, Karnataka, Rajasthan, Maharashtra, Uttar Pradesh, Madhya Pradesh, Assam, Biha ...