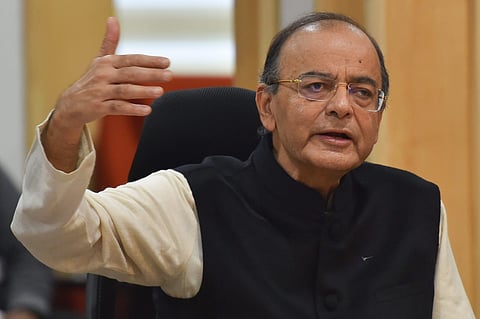

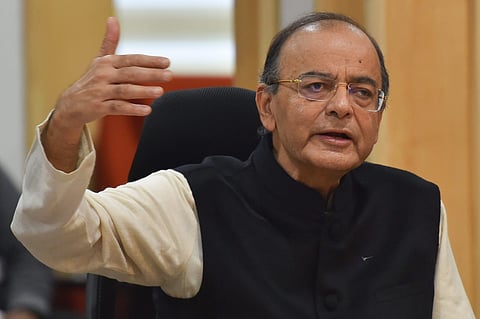

NEW DELHI: With the Central government incurring a revenue deficit of Rs 60,000 crore during the first nine months of the financial year, Finance Minister Arun Jaitley on Saturday said that revenue collection from the services sector has been disappointing, mainly on account of lower GST collection from the telecom, aviation and real estate sectors, and small traders.

“At a stage when we are looking at the (revenue) target, indirect tax is a little behind the scheduled direct tax; the direct tax is ahead of schedule. Our non-tax revenue also seems to be moving ahead fairly well,” Jaitley said, adding that lower indirect tax collection is mainly on account of services sector and small traders.

“While the manufacturing revenue is going up, revenue of services sector has not gone up,” the Finance Minister said.

He accepted that “the strong competition in the telecom sector has brought down revenue collection from the sector, which was once the top contributor for revenue”.

Other sectors that have followed a similar trend are aviation and real estate, and also small traders.

Jaitley said that while the telecom and aviation sectors are not under the purview of the GST Council, the council will work for the real estate sector and small traders in its next meeting.

“The Law Fitment Committee will take a view on GST on real estate in the next meeting. There’s is a consensus that something needs to be done on this,” he said.

Jaitley said the council will also rationalise rate for small traders, who are now out of the GST net. “The government is quite optimistic that we will be able to meet the fiscal deficit target,” he said.A proposal to form a seven-member Group of Ministers (GoM) to study the revenue trend was granted approval by the GST Council.

“The study would include the underlying reasons for deviation from the revenue collection targets vis-a-vis original assumptions discussed during the design of GST system, its implementation and related structural issues,” Jaitley said.

The government has budgeted to contain fiscal deficit at 3.3 per cent of the GDP in the current fiscal, lower than 3.5 per cent in 2017-18. As per the latest data, the fiscal deficit in the April-October period stood at 103.9 per cent of budgeted estimates.

Rate cuts may lead to 8% reduction in LED TV prices; ACs still in high slab

With the GST Council slashing rates on TVs up to 32 inches to 18% from 28%, consumers can expect at least eight per cent reduction in the prices of similar-sized LED TV. According to CEAMA, the reduction in prices will improve market sentiments and propel the demand in this category.

The industry was also hoping for a rate reduction on air conditioners, but unfortunately, they are still in the 28% tax slab.

Kamal Nandi, business Head, Godrej Appliances, said the increase in basic customs duty for imports has put further pressure on prices, dampening consumer sentiments.

Cement companies disappointed as GST Council retains highest tax slab

The decision to retain the 28% tax on the cement sector has dashed the hopes of cement firms that were anticipating a reduction in GST rate to 18% on the back of the government’s thrust on PM’s pet project — Housing for All by 2022.

The Cement Manufacturers’ Association said the tax incidence in India has affected the health of the industry that is witnessing only 70% of capacity utilisation due to low demand.

“In such a scenario, a lower tax rate on cement would have reduced prices which in turn could have benefited the housing segment,” said CMA President Mahendra Singhi.