NEW DELHI: The government is planning to divest its stake in state-run National Fertilizers Ltd (NFL) and Rashtriya Chemicals and Fertilizers Ltd (RCF) post-election with the aim of raising Rs 600 crore. The government has already said that it is considering selling its stake through the offer-for-sale (OFS) route.

“The process will start post-election. As specified, the stake sale will be via OFS route. We are planning to raise about Rs 500 crore from the divestment of the companies,” a senior official in the Department of Investment and Public Asset Management said.

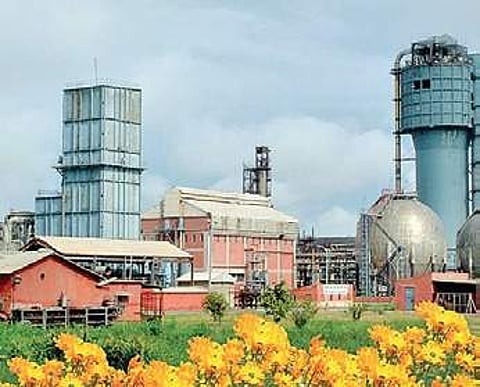

The proposed divestment includes selling 10 per cent stake in RCF. As of March 31, the government held 80 per cent stake in the fertilizer maker.“We are expecting to raise somewhere between Rs 240-250 crore from the RCF stake sale,” the official added. RCF is in the business of manufacturing and marketing fertilizers and industrial chemicals such as methylamines, ammonium bicarbonate and ammonium nitrate from its two operating units in Maharashtra.

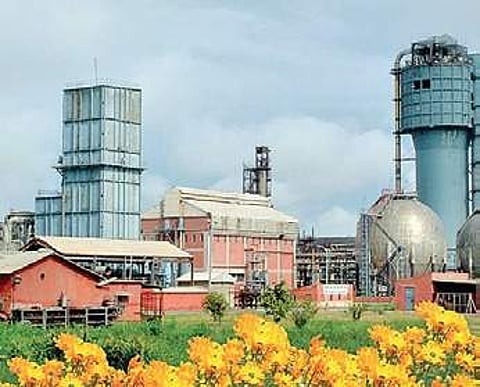

In the case of NFL, the government plans to bring down its stake by 20 per cent. The government is expecting to raise approximately Rs 350 crore.NFL is the second largest producer of urea, with a total share of 15.5 per cent, and it also produces bio-fertilizers.

In the current fiscal, the government has budgeted collecting Rs 90,000 crore through CPSE disinvestment in the current fiscal as against Rs 85,000 crore mopped up in 2018-19.

In March this year, the cabinet had allowed Alternative Mechanism to decide on the timing, price and quantum of shares of a state-run company to be put on the block for outright sale where CCEA has given in principle approval for it.