NEW DELHI: Unveiling the biggest tax reforms in the country, the Lok Sabha on Wednesday passed the four enabling Goods and Services Tax (GST) Bills after a marathon daylong discussions during which the government and the Opposition sparred over the scope of the legislation.

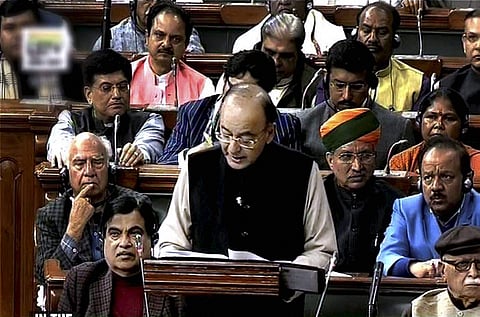

While the Finance Minister Arun Jaitely hailed the four GST Bills for having been drafted by the GST Council with consensus as a revolutionary step, the Opposition lamented that it was only a “baby step”.

While replying to the discussions, Jaitely refuted the claims of the Opposition that the agriculturists would come under the ambit of the GST. “Why are you presuming that 29 states, two union territories and the Central government will conspire to bring the agriculturists into the GST net? Your apprehension is misplaced,” Jaitely stated. The Finance Minister also countered the concerns of the Congress leader Veerappa Moily that the government by resorting to bring the four enabling GST Bills as Money Bills has sought to undermine the Rajya Sabha. “Since Independence, has there been any legislation which included proposals for taxation as anything but a Money Bill,” asked Jaitely.

The four enabling GST Bills passed by the Lok Sabha are Central GST Bill, Inter-state GST Bill, GST (Compensation to states) Bill, and The Union Territory GST Bill.

The Finance Minister also referred to the Chief Economic Advisor Arvind Subramaniam making a presentation before the GST Council wherein he argued for the inclusion of the Real Estate into the ambit of the GST network. “The government of the Union Territory of Delhi was the first state to support the inclusion of the Real Estate into the GST network. Afterwards the Finance Minister of Delhi made presentation before the GST Council for the inclusion of the Real Estate into the GST network,” stated Jaitely, while adding that the final decision on inclusion of the Real Estate into the GST network would be taken within one year of the rollout of the taxation reforms. He also stated that the petroleum products have similarly been included for the futuristic purpose and upon consensus among the states it could also be brought into the ambit of the GST network with administrative decision without needing amendment in the laws. The minister added that the states did not agree for the inclusion of the potable alcohol into the ambit of the GST.

Justifying the multiple tax rates, the minister argued that “Hawai chappal and BMW cannot have the same rates”. He added that the food items will have the zero rates, while the sin commodities will have the highest rate of 28 per cent along with a cess for the five years. He also claimed that the rollout of the GST would have moderating influence on the prices of commodities, which will make them cheaper. Jaitely responded to various interruptions in the House on tax rates by saying that the GST Council will recommend rates on different commodities. He also justified the anti-profiteering clause in the Bills, saying that the benefits of tax rebates have to be passed onto the consumers.

However, the Shiromani Akali Dal (SAD) MP Prem Singh Chandumajra, while taking part in the discussion, argued that the GST rollout would have regressive impact on agriculture, as leasing of land, agricultural allied activities, including dairy products, horticulture would come under the tax net.

The Congress MP Moily, while initiating the discussion, slammed the government saying, “What you have brought today is not a game-changer, or great reform, but a baby step forward. This will be a technological nightmare.” He said that categorisation of goods also needs to be done. He posed a number of questions -- “Is Kitkat a chocolate or a biscuit? Is coconut oil considered as hair oil or cooking oil?

“The changes we are about to implement are unprecedented and historic. It was intended by the UPA government and should have been implemented then, but some Opposition parties at the time thought it should not have been done. Imagine the loss to the country, to the people, due to a political gamble. It amounts to a loss of about Rs. 12 lakh crore,” said Moily.

The Congress leader argued that as far as the tax rates are concerned, the government must resist from placing too many goods in the 18 per cent tax bracket. The Opposition MPs also wondered what would be the fate of compensation to states after five years on account of loss of revenue.

The RSP MP N K Premchandran, while taking part in the discussions, claimed that the power of the Parliament would be taken off as the tax rates would be decided by the GST Council. However, Jaitely clarified that the Parliament and the state legislature would continue to legislate on tax rates