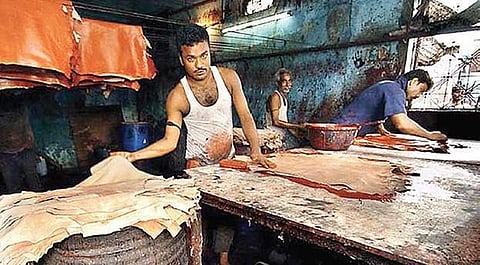

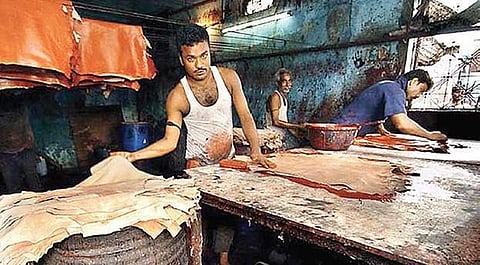

CHENNAI: The leather industry with an export turnover of USD 5.6 billion would require an additional capital requirement of "over Rs 3,000 crore" following implementation of the Goods and Service Tax, an industry official said today.

"Because of GST, there will be an additional working capital requirement of over Rs 3,000 crore and since 80 per cent of businesses in this industry are small scale, they are finding it difficult..," Council for Leather Exports Chairman Mukhtarul Amin told reporters here.

Elaborating, he said small and medium enterprises which comprise 80 per cent of the sector would be unable to make the capital requirement and "may be forced to shut during coming months."

Amin said the Centre's duty drawback scheme announced for leather exporters should be extended till March 2018 as significant amount of capital for the exporters were already blocked on the account for payment of GST.

"As GST refund mechanism is not yet ready, the full drawback scheme has to be extended upto March 2018," he said.

Amin requested the government to reduce GST from the current 12 per cent to five per cent collected for finished leather goods.

He also said there should be reduction of tax rates from 18 per cent to five per cent on job work to manufacture leather products.

"Collecting 18 per cent of GST on job work rendering will make most of industries jobless," he said.

India's leather exports have been "flat" over the last three years he said and added the government should provide some incentive as the leather exports from new markets like Bangladesh and Vietnam were increasing.