HYDERABAD: Even as over-indebtedness was crushing him and the company, Coffee Day Enterprises founder VG Siddhartha continued borrowing, raising as much as Rs 1,500 crore in last six months. Data from the Registrar of Companies shows that capital was raised mostly by pledging shares, but not a penny was used to retire existing debt.

Between January and February, 61.31 per cent stake in Tanglin Development was pledged in lieu of Rs 1,015 crore (51 per cent with Axis Trustee for Rs 915 crore and 10.31 per cent with RBL Bank for Rs 100 crore).

As recent as in May, another Rs 175 crore was borrowed from Piramal Trusteeship Services, even as the company mounted efforts to pare debt by offloading promoter stake in other entities. But it is unclear where the capital was deployed, while tax officials aren’t ruling out suspicious transactions. “The Board should assure that a thorough investigation is undertaken and the true state of affairs will be disclosed and transparecny ensured,” Shriram Subramanian, founder, InGovern Research Service, told TNIE.

Interestingly, the Rs 3,200 crore proceeds from L&T towards 20.32 per cent stake sale in Mindtree was of little use. On March 22, complying with the income-tax department, which attached Mindtree shares, the holding entity Coffee Day Enterprises opened an escrow account for Rs 3,000 crore (again by pledging shares) with IDBI Trusteeship Services Ltd. As opposed to reducing the group debt, the transaction didn’t offer any respite.

In all, with six subsidiaries and nearly 30 associates and joint ventures, Coffee Day Enterprises’ consolidated debt as on March 2019 stood at over Rs 6,500 crore, including debt of another listed entity, Sical Logistics.

From a letter purportedly written by Siddhartha, which the tax sleuths dismissed due to a mismatch in signature, the valuation of the companies he founded far exceeds the overall debt, raising questions about why he resorted to an alleged attempted suicide.

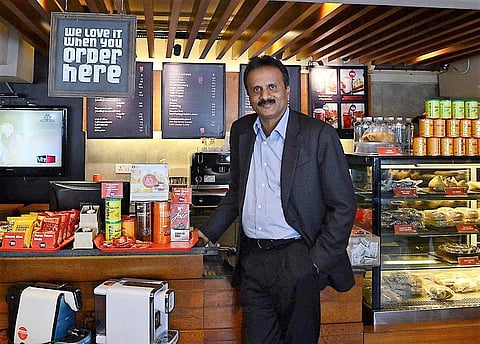

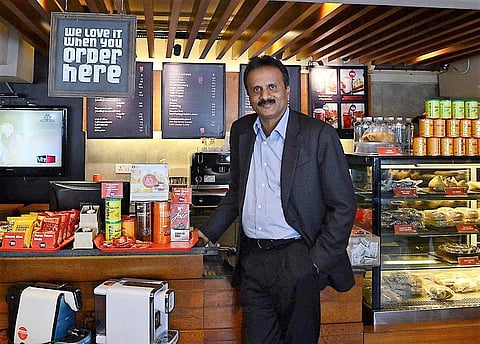

The flagship brand Coffee Day Global Ltd alone is valued at Rs 7,000-8,000 crore, which is 3-4 times its current revenue run rate of Rs 2,200 crore. Reportedly, Siddhartha was in talks with beverage giant Coca-Cola to sell it for an estimated Rs 10,000 crore.

Other subsidiaries including the Coffee Plantations division was valued at Rs 2,000 crore, while timber assets are pegged at another Rs 1,000-1,300 crore. The promoter’s equity stake in Sical Logistics is valued at Rs 1,000-crore, while other subsidiaries, associates and joint ventures including Tanglin Development, Way2Wealth, Ittiam, Magnasoft and Serai are together valued at Rs 5,000 crore.