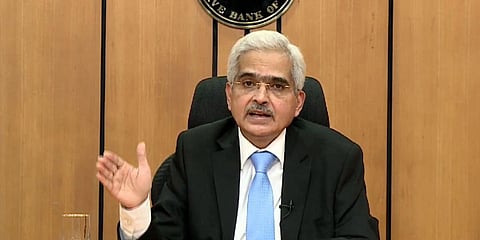

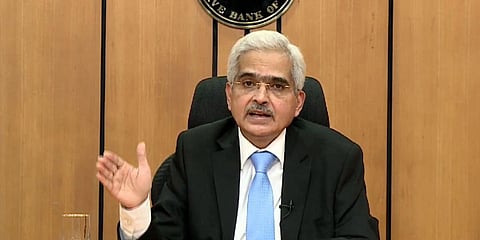

MUMBAI: The Reserve Bank has pumped Rs 1.2 lakh crore of fresh currency into the system in last 45 days since the COVID-19 outbreak in the country, Governor Shaktikanta Das said on Friday. Automated teller machines and business correspondents, who take banking services to far flung areas, are also working at high capacity levels to ensure financial services reach everybody, he said.

The comments on currency come amid media reports of a Rs 86,000 crore jump in currency circulation in March and also a greater tendency among people to withdraw to hoard cash amid the lockdown. "Regional offices of the RBI have supplied fresh currency of Rs 1.2 lakh crore from March 1 till April 14 to currency chests across the country to meet increased demand for currency in the wake of the COVID-19 pandemic," Das said in his video message over social media.

He lauded banks for rising to the occasion and ensuring that ATMs are refilled regularly despite the logistical challenges during the lockdown. Additionally, there has not been any downtime in internet or mobile banking as well, he said.

The governor said that banks have been required to put in place business continuity plans to operate from their disaster recovery (DR) sites or identify alternate locations for critical operations so that there is no disruption in customer services.

Das said that 150 officials from the RBI are in quarantine, but they are looking after currency functions like in circulation, retail and wholesale payment and settlement systems, reserve management, financial markets and liquidity management, financial regulation and supervision, and a host of other services available so that "the nation may survive COVID-19".