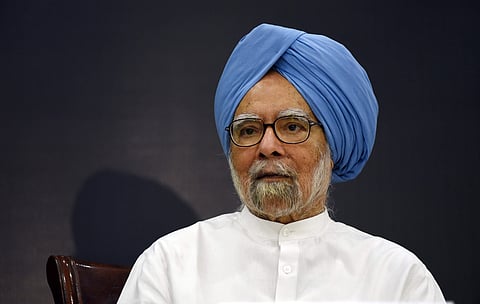

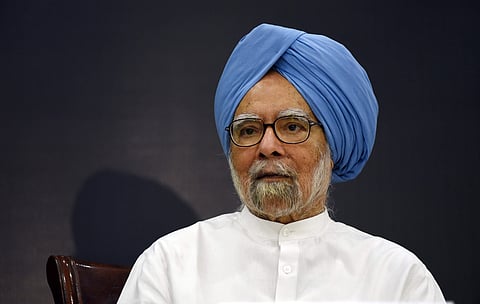

Former Prime Minister and well-known economist Dr Manmohan Singh feels the COVID-19 triggered economic slump is inevitable and has advised direct cash transfers to people and a Government-backed credit guarantee programme for firms as remedies.

Dr Singh, who along with former Prime Minister Narasimha Rao is widely seen as the architect of economic reforms in India that started in the 1990s, said in an e-mailed interview to the BBC that the Government needs to ensure the protection of people's livelihoods "through significant direct cash assistance."

As part of a three-pronged plan, he also sought provision of a "Government-backed credit guarantee programme" to support capital-starved businesses.

Several top economists including Nobel Laureate Abhijit Banerjee have suggested stepping up the programme of direct cash transfers to poor people as well as payroll support so that ordinary citizens have money in their pockets to boost demand, which has been in short supply.

ALSO SEE:

The former Prime Minister, who led India's government from 2004 till 2014, also suggested that the Government should consider "institutional autonomy and processes" in a bid to fix India’s financial sector which has seen several banks and financial companies falling by the wayside.

He also said a "deep and prolonged economic slowdown" was "inevitable".

India's GDP, which grew by 4.2 per cent last financial year, is forecast to shrink by 5-10 per cent by various economists. Industrial production in the country shrank by 57.6 per cent in April and by 34.7 percent in May and is expected to be in negative territory in this quarter too.

India went in for a strict lockdown from the last week of March but has been 'unlocking' itself to allow economic activity to get back on stream. However, analysts see a pick-up in growth getting hampered by a combination of weak demand and re-imposition of lockdowns in many parts of the country as Coronavirus cases spread in the hinterlands or resurfaces in urban areas.

Dr Singh also pointed out that as the country was far more integrated with the global economy than before, "what happens in the global economy will have a significant impact on India’s economy."

He seemed to feel mere monetary policy changes would not yield results. He pointed out that the nature of the economic crisis was different from before.

"Now we have an economic crisis caused by an epidemic which has induced fear and uncertainty in society, and monetary policy as an economic tool to counter this crisis is proving to be blunt," he said.

The Reserve Bank of India has reduced key policy rates by 2 per cent since the Covid pandemic started and has also pumped in credit into the market. However, this has not seen businesses taking on more credit. Instead what has been seen is a slump in credit offtake as firms struggle to meet their expenses in the face of lockdowns and low demand for goods and services.