NEW DELHI: After the Federation of Indian Chambers of Commerce & Industry (FICCI) voiced its concerns over 5% levy on hospital rooms with rent exceeding Rs 5,000, the government justified its move by saying a very small percentage of such rooms are there in the country.

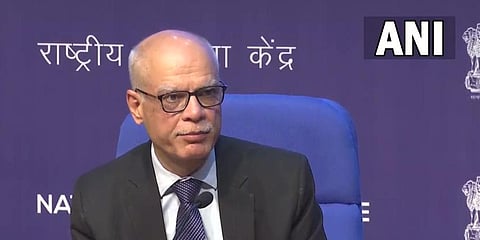

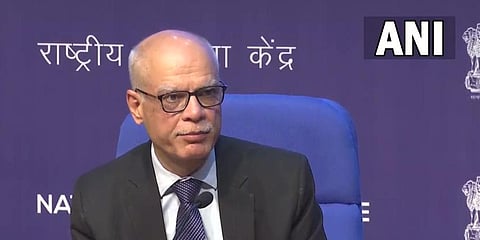

Revenue secretary Tarun Bajaj on Tuesday said the decision would not affect affordable healthcare services. “If I can spend Rs 5,000 on a room then I can also pay Rs 250 as GST on it. I don’t see any reason as to why a 5% tax rate would hit the affordable segment,” Bajaj added.

Speaking on the sidelines of an event hosted by the Confederation of Indian Industries (CII), Bajaj also said the government-appointed Group of Ministers (GoM) is looking at GST rate rationalisation. He said there is a need to wait for some time as the GST Council would not like to burden the consumers in these times. He further added that there is a need to prune the exempted-GST items.

Bajaj also emphasised the need for continuing with 28% GST slab in a developing country like India. He said as there is a lot of disparity in income levels of people in the country, it is imperative to impose higher taxes on luxury and sin goods. He also expressed his doubts over the implementation of one GST rate citing challenges. However, he added that it would be easier to merge 5%, 12% and 18% into two slabs.

“I don’t know whether India is ready to go for one GST rate… But, perhaps with time as we keep correcting the inverted duties and get rid of exemptions, I think perhaps this 5%, 12%, and 18% can first go into two rates. But it’s a challenge even to do that,” Bajaj stated. In addition, he said, 28% slab in GST contributes 16% to the gross GST collection, whereas as much as 65% of the total revenue comes from 18% slab. Slabs of 5% and 12% contribute 10% and 8% respectively to the total gross GST revenue.