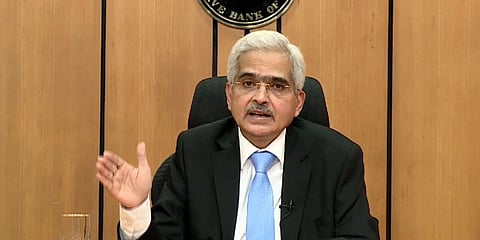

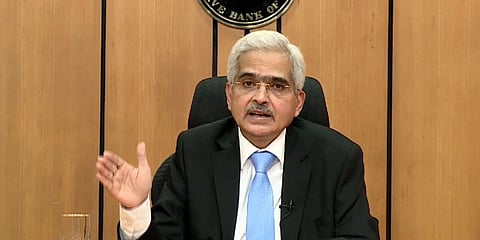

NEW DELHI: The Monetary Policy Committee (MPC) on Friday decided to keep the interest rates unchanged for the eleventh time in a row, the Reserve Bank of India’s Governor Shaktikanta Das said.

The repo rate and reverse repo rate remain the same at 4 per cent and 3.35 per cent respectively.

The MPC had met on April 6-April 8 and they voted unanimously to remain accommodative while focusing on withdrawal of accommodation to ensure that the inflation remains within the target going forward while supporting growth.

“The marginal standing facility (MSF) and bank rate remain unchanged at 4.25 per cent. Further, it has been decided by the RBI to restore the width of the liquidity adjustment facility(LAF) to 50 basis points,” Das said.

The expected positive benefits of the Omicron wave have been offset by a large escalation in geopolitical tensions which has significantly changed the external and domestic landscape. Concerns over protracted supply disruptions have rattled the commodities and financial markets. Global supply chain disruptions and input cost pressures are now expected to linger for a longer time. Resurgence in covid cases in many countries further exacerbated the supply chains, added Das.

“Overall the external developments over the past two months have led to materialisation of downside risks to domestic growth and upside risks to the inflation projections which were made in February this year during MPC meet,” he further stated.

“Conflict in Europe has the potential to derail the global economy. Caught in the cross-current of multiple headwinds, our approach needs to be cautious nut proactive in mitigating the adverse impact on India’s growth, inflation and financial conditions,” the RBI head said. He further added that the large foreign exchange reserves, improvement in external indicators and the substantial strengthening of the financial sector would help to weather this storm.

Growth

“Real GDP growth for 2022-2023 is now projected at 7.2 per cent with Q1 at 16.2 per cent, Q2 at 6.2 per cent, Q3 at 4.1 per cent and Q4 at 4 per cent assuming that the Indian crude oil basket at $100 per barrel during 2022-2023,” Das added.

According to the MPC, consumer confidence and household optimism in outlook are improving. Businesses are optimistic about the revival in economic activity. On the other hand, passenger vehicle sales and registrations continue to contract, although at a moderate pace. Both Services and Manufacturing PMIs remain in the zones of expansion. However, the Manufacturing PMI moderated slightly in March.

“As the horizon was brightening up, escalating geopolitical tensions have cast a shadow on our economic outlook. Although India’s direct trade exposure to the countries at the epicentre of the conflict is limited, war could potentially impede the economic recovery through elevated commodity prices and spill-over challenges,” Das said.

Inflation

“Inflation is now projected at 5.7 per cent in 2022-2023 with Q1 at 6.3 per cent, Q2 at 5 per cent, Q3 at 5.4 per cent and Q4 at 5.1 per cent,” Das said.

Edible oil price pressures will likely be elevated in the near term due to export restrictions and loss of supply from black sea regions. Milk, dairy and poultry prices could also remain under pressure. High international commodity prices and supply pressures will lead to high inputs costs across, agriculture, manufacturing and the services sector thereby impacting the retail prices.