Central banks are the loudest drummers of rate hikes. Some like the US Federal reserve even signal 'talking about talking about' policy tightening. As for the RBI, it's the unexpected, always. Or so it seems.

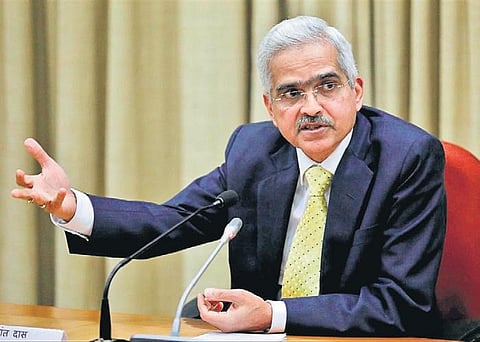

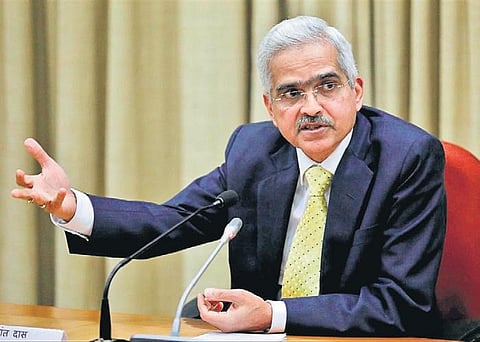

If the summer of 2020 saw emergency rate cuts, the RBI has now ensured that the lift off is equally sudden and unplanned. On Wednesday, Governor Shaktikanta Das announced an out-of-turn 40 bps (0.40%) repo rate hike and a 50 bps (O.50%) increase in cash reserve ratio (CRR) -- a full 30-odd days ahead of the June policy meeting.

If you consider the newly introduced Standing Deposit Facility (SDF) rate at 40 bps higher than the reverse repo rate announced last month, RBI effectively raised the policy rate in its April policy itself. It means Wednesday's rate hike makes the effective rate higher by 80 bps.

None of us threw Das a 'Hello, May. Surprise me" challenge. It's the price unpleasantness that pressed him and the Monetary Policy Committee (MPC) into action. Amid soaring food and energy prices, analysts expect more 50 bps jackings to follow in June, with a near-term repo rate pause at 5.15% or thereabouts.

At this juncture and from a policy viewpoint, rate hikes may be good for the economy, but just not for you. Interest rates and EMIs will shoot up at a time when wage inflation is barely breathing. Household budgets are under strain as it is thanks to rising prices, and higher borrowing costs will put further stress. The only upshot is that real rates will move towards neutral over the next few quarters and will benefit savers.

The rate hike decision comes just hours before the US Fed's rate decision of a likely 50 bps rate hike. Importantly, it coincides with the landmark opening of the LIC IPO, which only shows that the MPC will not hesitate to act if the situation warrants so.

That situation is all down to inflation. While March saw a near 100 bps higher-than-anticipated inflation print, April's figure is likely to stay elevated. But both food and fuel inflation are supply-side issues, and rate hikes hardly help lower prices. In fact, RBI maintained as much until recently.

So why did Das take such sound central banking logic and knock it 180 degrees out of phase, that too when growth continues to be weak? Analysts say the repo rate hike is to ease inflationary expectations, if not actual prices. For central banks, anchoring inflation expectations is essential so as to avoid extreme rate hikes later.

ALSO READ | 'Economy faces headwinds from global spillovers': RBI sounds caution amid inflation crisis

Meanwhile, Das clearly laid out the rationale for hiking policy rates, saying RBI was not adhering to any defined playbook, and that the move was a response to heightened uncertainty in the global macro backdrop. Wednesday's 40 bps rate hike wasn't a shift in policy accommodation either, as the stance and policy conditions remain accommodative.

The bigger surprise was the CRR hike, indicating RBI's intent on withdrawing liquidity at a faster pace. The CRR hike unwinds the easy monetary policy and would tighten liquidity by Rs 90,000 crore. This will likely improve the transmission of rate hike in credit and debt market.

Analysts say the hike is to ease inflationary expectations, if not actual prices. For central banks, anchoring inflation expectations is essential so as to avoid extreme rate hikes later. Turns out what people think is crucial for policymaking.