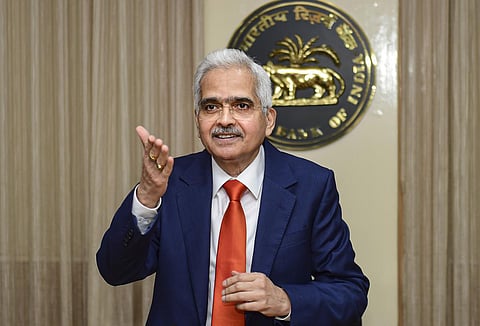

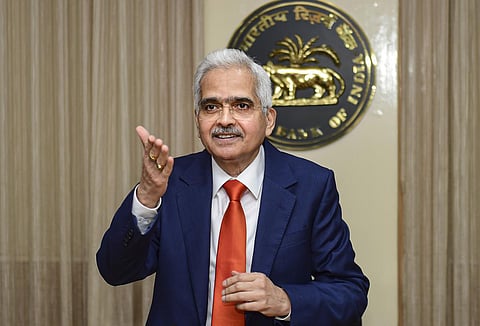

MUMBAI: The Reserve Bank of India wishes to concentrate on inflation in the same way as Arjuna focussed on hitting the eye of a revolving fish in the epic Mahabharata, Governor Shaktikanta Das said on Wednesday.

"No one can match the prowess of Arjuna, but our (RBI's) constant effort is to keep an Arjuna's eye on inflation," Das said at the annual FIBAC conference of bankers here.

The remarks come at a time when inflation is ruling high and RBI will soon be explaining to the government about the reasons for overshooting the inflation target for nine consecutive months.

Probably hinting at various factors which influence his own fight against inflation, Das said Arjuna would have assessed the speed at which the fish was revolving, the prevailing wind conditions, the intensity of the ripples in the pool of water below and the noise levels in the king's court while aiming at the fish.

Das also defended RBI's strategies in the recent past amid criticism over price rise.

He said the country would have had to pay a heavy price if RBI had begun tightening earlier than when it did, hinting that the process of recovery had to take root in the economy first.

Das also said that RBI's rate-setting panel will be meeting on Thursday to formulate a reply which will detail the circumstances that led to missing the inflation target and the corrective measures it plans to undertake.

Further, the governor said RBI chose to utilise the flexibility available in the monetary policy framework to tolerate a slightly higher inflation which was within the 2-6 per cent target range to ensure that overall economy remained resilient and financial stability was maintained.