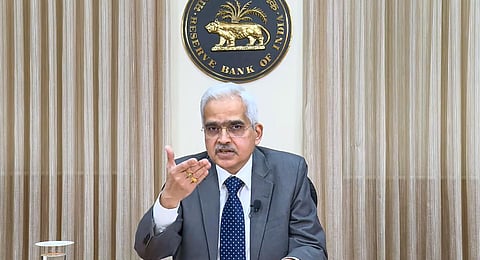

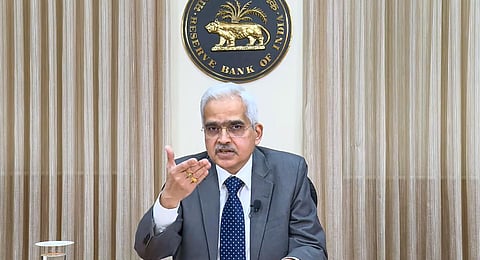

MUMBAI: The Unified Payments Interface (UPI) has revolutionised the country’s digital payment ecosystem and played a pivotal role in driving financial inclusion by bringing millions of unbanked individuals into the formal financial system, said RBI Governor Shaktikanta Das on Monday.

The Governor was delivering the keynote address at the Grand Finale of the G20 TechSprint 2023. “A landmark example of our commitment to innovation is the UPI, which has been a game changer for India’s digital payment ecosystem. It has helped drive financial inclusion by bringing millions of unbanked individuals into the formal financial system,” said RBI Governor.

“With over 10 billion transactions a month, the UPI has become the backbone of digital payments in India and has helped to catalyse a wave of innovations in the fintech sector,” he added. He noted that over 70 mobile apps and over 50 million merchants across India now accept UPI payments.

In his address, Das commended India’s thriving start-up ecosystem, its vibrant talent pool, and its commitment to digital transformation. India, he emphasised, is focusing on leveraging technology to bridge gaps, empower individuals, and promote financial inclusion.

“TechSprint 2023 resonates with India’s commitment to innovation. With its robust startup ecosystem, vibrant talent pool and unwavering commitment to digital transformation, India is now focusing on the way technology can be harnessed to bridge gaps, empower individuals and promote financial inclusions,” he added.