The Indian equity market remained under selling pressure on Thursday morning even as the Reserve Bank of India (RBI) kept the policy rates unchanged in line with expectations.

Investors booked profit as the regulator increased its inflation forecast for the current financial year, indicating that won’t be any rate cut in near future.

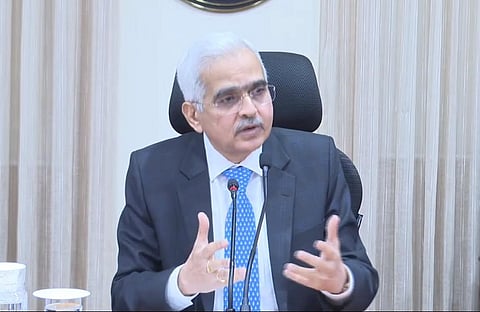

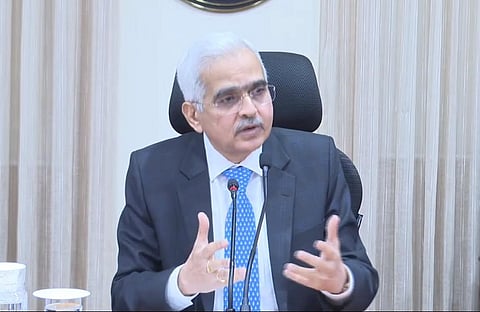

The RBI's Monetary Policy Committee (MPC) increased its CPI inflation forecast for FY24 to 5.4% from 5.1% earlier, governor Shaktikanta Das said. At the same time, he said, the central bank is focused on aligning inflation to the target of 4%. “MPC remains resolute in its commitment to align inflation with the 4% target and anchoring inflation targets," said Governor Das.

The Sensex and Nifty fell over half a percentage point with banking stocks facing additional pressure after the RBI said that starting fortnight August 12, banks will have to maintain an incremental cash reserve ratio (CRR) of 10% on the increase in their Net Demand and Time Liabilities (NDTL) between May 19 and July 28.

“This measure is intended to absorb the surplus liquidity generated by various factors referred to earlier, including the return of ₹2000 notes to the banking system. This is purely a temporary measure for managing the liquidity overhang, said Governor Das.

Following this, Nifty Bank Index fell over half a percentage points with shares of heavyweights such as HDFC Bank, ICICI Bank, Axis Bank and Kotak Mahindra Bank falling up to 1%.

Santosh Meena, Head of Research at Swastika Investmart, said that the implementation of a 10% incremental Cash Reserve Ratio (CRR) added to the market's unease.

“Presently, the market sentiment appears to be largely unaffected by the policy changes. However, the short-term market structure seems to lean towards a sell-on-rise pattern. This is partly due to the global market's nervousness, exacerbated by the jump in crude oil and other commodity prices, posing notable challenges for the Indian market,” said Meena.

Looking ahead, the focal point of market attention is expected to shift toward the impending US inflation figures scheduled for release this evening, added Meena.

V K Vijayakumar, Chief Investment Strategist at Geojit Financial Services said that the MPC has delivered in line with market expectations on rates, stance and tone, with the rates being retained and the stance and the tone turning hawkish.

“The significant change is the upward revision in FY24 CPI inflation projection from 5.1% to 5.4%. This means the high policy rates will remain high for long, and, therefore, a rate cut can be expected only in Q1 FY25. From the market perspective, there are no positive or negative surprises in the policy,” added Vijayakumar.

Lakshmi Iyer, CEO - Investment & Strategy, Kotak Alternate Asset Managers Limited, said, “CPI forecast for FY 24 has been revised upward to 5.4%, which again was largely priced in. Incremental CRR hike (95,000 cr of liquidity suck out) to be temporary in nature to address liquidity addition on account of withdrawal of Rs 2000 notes. This could dampen short-term bond yields in the near term. Bond prices could see relief buying as the mood was quite sombre assuming a very hawkish commentary.”