Vedanta Limited, a global leader in the natural resources sector, has recently announced its production results for the fourth quarter and year ended March 31, 2024. The company has achieved significant milestones across its various business segments, demonstrating its operational excellence and commitment to growth.

Fourth Quarter Results (Q4 FY24)

In the aluminium segment, Vedanta's Lanjigarh refinery produced 484 kilotons (kt) of alumina in Q4 FY24, representing an 18% year-on-year (YoY) growth and a 3% quarter-on-quarter (QoQ) increase. The company's aluminum smelters achieved a production of 598 kt, up 4% YoY.

In Vedanta's Zinc India business, mined metal production stood at 299 kt, up 11% QoQ, driven by a mix of improved mined metal grades and higher ore production across mines. However, it was down 1% on the year. Refined zinc production reached 220 kt, up 9% QoQ and 2% YoY, while refined lead production was at 53 kt, lower by 2% YoY and 5% QoQ. Silver production stood at 189 kt, up 4% YoY but lower by 4% QoQ.

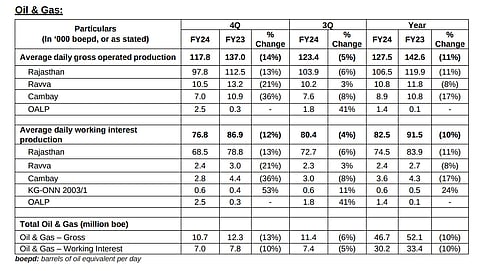

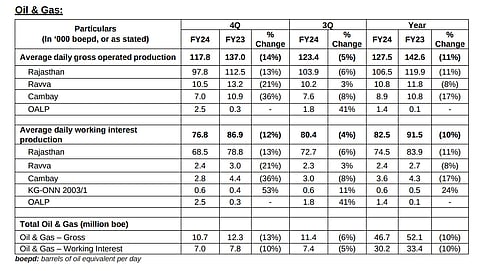

In the oil and gas segment, Vedanta's average gross operated production was 117.8 kboepd (thousand barrels of oil equivalent per day) in Q4 FY24. The company's Rajasthan block recorded an average production of 97.8 kboepd, lower by 6% QoQ and 13% YoY, primarily due to the natural decline in the MBA fields, partially offset by infill wells brought online.

Vedanta's iron ore business in Karnataka achieved a saleable ore production of 1.7 million tonnes in Q4 FY24, up 13% YoY and 23% QoQ, driven by improved operational efficiency and process improvements. The company's pig iron production stood at 198 kt, up 6% YoY, driven by improved process efficiency.

In the steel segment, Vedanta's total saleable production was 343 kt in Q4 FY24, lower by 11% YoY, in line with lower hot metal production.

Vedanta's FACOR business recorded ore production of 79 kt in Q4 FY24, up 55% YoY and 20% QoQ, driven by improved operational efficiencies. Ferro chrome production stood at 27 kt, up 38% YoY and 23% QoQ, driven by capacity enhancement and improved productivity.

Annual Results (FY24)

Vedanta's aluminium business achieved a remarkable milestone in FY24, with its Lanjigarh refinery producing 1,813 kt of alumina, up 1% YoY. The company's smelters recorded the highest ever cast metal aluminium production of 2,370 kt, up 3% YoY, demonstrating Vedanta's operational excellence in the aluminium segment.

In the zinc segment, Vedanta's Zinc India business delivered its best-ever mined metal production at 1,079 kt, up 2% YoY, driven by improved mined metal grades. Refined metal also achieved its highest annual production, with silver recording the highest volume in FY24 at 746 kt, up 5% YoY.

Vedanta's oil and gas business recorded an average gross operated production of 127.5 kboepd in FY24. The natural decline in production was partially offset by infill wells brought online across all assets, showcasing Vedanta's expertise in reservoir management.

The company's iron ore business in Karnataka achieved its highest ever annual saleable ore production of 5.6 million tonnes, up 5% YoY. Vedanta's pig iron production also reached a record high of 831 kt, up 19% YoY, driven by improvements in process efficiency.

In the steel segment, Vedanta recorded its highest ever annual production of 1,386 kt, up 8% YoY, on account of debottlenecking and improved operational efficiency.

Vedanta's FACOR business witnessed an 18% YoY increase in ferro chrome production, reaching 80 kt in FY24, driven by capacity addition through the commissioning of new furnaces.

The company's power segment demonstrated growth, with overall power sales increasing by 10% YoY to 16,325 million units in FY24. Vedanta's Talwandi Sabo Power Limited (TSPL) plant achieved an 82% availability factor, ensuring a reliable power supply to its customers.

Vedanta's record-breaking production results in FY24 are a testament to its operational excellence, innovation, and commitment to sustainable growth. As the company continues to focus on ESG principles and social responsibility, it is well-positioned to create long-term value for all its stakeholders and contribute to India's economic development.