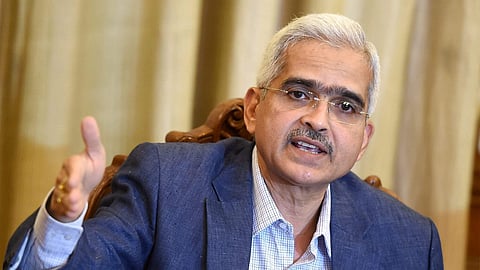

MUMBAI: Reserve Bank governor Shaktikanta Das Monday asked the money and government debt market dealers to work towards better price transparency by ensuring effective market-making and finer pricing for smaller deals so that retail customers won’t be left out.

“Transparency in (money and forex) pricing remains a work in progress and more can be done. The retail customer is yet to get a deal at par with large customers. There is a need for effective market-making and finer pricing for smaller deals on NDS-OM,” Das told the annual conference of the FIMMDA-PDAI in Barcelona.

While Fimmda is the Fixed Income Money Market and Derivatives Association of India), the PDAI is the Primary Dealers Association of India and NDS-OM is the negotiated dealing system-order matching system, which is an electronic, screen-based, anonymous, order-driven trading system for dealing in government securities.

Noting that the divergence in pricing in forex markets for the small and large customers are wider than what can be justified by operational considerations, Das said banks may need to do more to facilitate the use of the forex retail platform of the RBI.

He also asked banks to ensure that unauthorsied dealers are not active in the market, saying the RBI still sees banking channels are being used by certain persons or entities to fund activities on unauthorised forex trading platforms. This warrants enhanced vigilance by the banks, Das said.

On the derivatives market, he said participation of domestic banks in derivative markets remains limited with only a small set of active market-makers.

Participation of domestic banks in global markets is growing but it is quite small.