MUMBAI: Reiterating the need for sustainable price stability to ensure long-term sustainable growth, the Reserve Bank-led monetary policy committee has voted to keep the key policy rate unchanged at 6.50 percent, for a record ninth consecutive time.

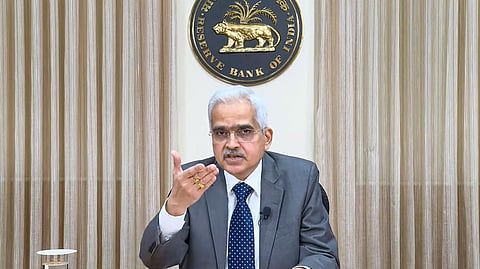

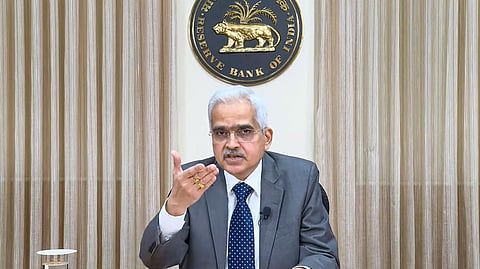

Deliverying the outcomes of the three-day policy review, Governor Shaktikanta Das Thursday morning, said the MPC decisions are by a vote of 4 to 2 with the latter voting for a change in the rates as well as the stance, which continues to be withdrawal of accommodation which means controlling excess liquidity on a longer term.

Citing the rationale for the statusquoish policy, Das said given the stubborn retail inflation, caused primarily by the supply side-induced higher prices of food and vegetables, which constitute a whopping 45 percent of the consumer price index, and the likely losing of a base effect driven fall in the price indices in the ongoing second quarter, “it makes immense for the RBI and MPC to stay the course of fighting inflation and bring it down to the targeted 4 percent on a durable basis so that the economy and the households benefit from lower prices.”

The MPC cannot but remain on course focused on taming inflation to a sustainable and durable basis because the present inflation tends to be more driven by sticky food prices and not transitory in which case we could have overlooked it, the governor said explaining the rationale for the decision of continuing to focus on inflation and not shift its attention elsewhere.

The central bank also retained the recent upward revision of growth at 7.2 percent and also retained the inflation target for the year at 4.5 percent.

The last time the MPC increased the rates was an unconventional 35 pbs to 6.5 percent was in the February 2023 review. Since the market wasn’t expecting a rate cut, it was trading down around 300 points more or less at the same level it opened at 1030 hrs.