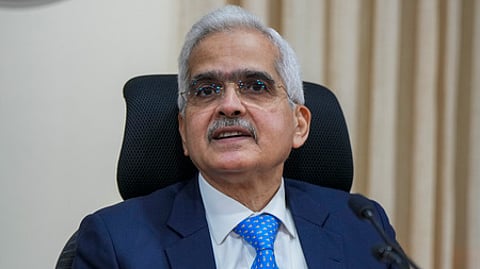

MUMBAI: The Reserve Bank is piloting an application for frictionless credit —Unified Lending Interface (ULI). It will be launched nationwide soon and will become the UPI on the credit side, Governor Shaktikanta Das said.

The new technology is aimed at reducing the time taken for appraisal, especially for small borrowers in rural areas, he added.

"The Reserve Bank had last year started a tech platform for enabling frictionless credit. The central bank proposes to call it a Unified Lending Interface (ULI). The initiative is still in the pilot stage and will be launched in due course," said Das, while delivering the keynote address at the Global Conference on Digital Public Infrastructure and Emerging Technologies, a part of the RBI@90 initiative in Bengaluru Monday.

"The ULI facilitates a seamless and consent-based flow of digital information, including land records from multiple data providers to lenders. It cuts down the time taken for credit appraisal, especially for rural and smaller borrowers and its architecture is designed for a plug-and-play approach to enable quicker access.

ULI improves digital access from diverse sources for lenders. The ecosystem is based on the consent of potential borrowers and data privacy is protected," Das said.

The RBI is constantly working on devising policies, systems and platforms to make the financial sector stronger, nimble, and customer-centric, he said.

However, the governor also cautioned financial institutions about the risk of technology, especially artificial intelligence.

He further said the UPI system has the potential to evolve into a cheaper and quicker alternative to the available channels of cross-border remittances and “a beginning can be made with small value personal remittances as it can be quickly implemented”.

Speaking on the theme of DPI (digital public infrastructure) and emerging technologies, he said over the last decade, the traditional banking system has undergone an unprecedented technological transformation.

By all indications, this process is likely to become even more intense in the coming years, he added.

He said DPI spurs market innovation by reducing transaction costs, democratising access, maintaining competition through interoperability, and attracting private capital.

“The advantage of developing DPI in the public sector is that typically the private sector would be averse to capital investment to create infrastructure with uncertain returns,” the governor said and added that privately created infrastructure may not also be amenable to democratised access or interoperability.