RBI to issue principle-based framework for multi-factor authentication of payment transactions

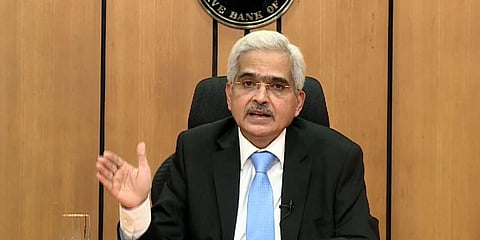

Reserve Bank of India will soon issue guidelines for a principle-based framework for authenticating digital payment transactions, Governor Shaktikanta Das said on Thursday after the bimonthly monetary policy committee meeting.

A "principle-based framework" refers to a system or structure that operates according to a set of fundamental guidelines or beliefs, which guide decision-making and behavior within that framework.

".....Though RBI has not prescribed any particular AFA (additional factor authentication), the payments ecosystem has largely adopted SMS-based One Time Password (OTP). With innovations in technology, alternative authentication mechanisms have emerged in recent years," Das stated.

"To facilitate the use of such mechanisms for digital security, it is proposed to adopt a principle-based “framework for authentication of digital payment transactions”. Instructions in this regard will be issued separately,” the Governor added.

Aadhaar Enabled Payment System

Furthermore, he said Aadhaar Enabled Payment System (AEPS) has played a critical role in facilitating digital transactions for over 37 crore users in 2023.

He also outlined plans to enhance the security of such transactions through streamlined onboarding processes and additional fraud risk management requirements. Instructions on these matters are expected to be issued separately in the future.

Das also announced a new pilot program to enhance Central Bank Digital Currency (CBDC) transactions.

"It is now proposed to enable additional functionalities of programmability and offline capability in CBDC retail payments. Programmability will facilitate transactions for specific/targeted purposes, while offline functionality will enable these transactions in areas with poor or limited internet connectivity," Das added.