NEW DELHI : On the back of new fund offers (NFOs), monthly inflows into equity-based funds surged to a 23-month high of Rs 26,866 crore in February 2024. However, there was a sequential decline in mid-cap and small-cap fund inflows amid increased liquidation by asset management companies (AMC) over hefty valuation concerns.

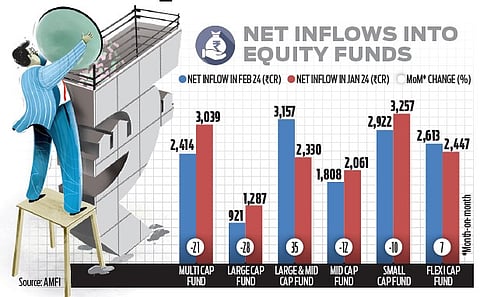

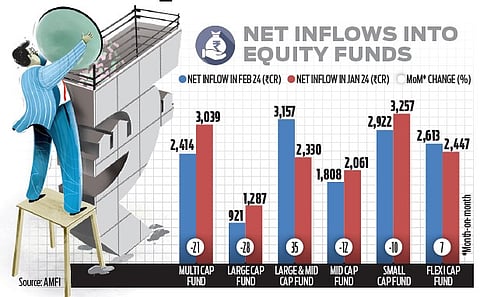

Data released by the Association of Mutual Funds in India (AMFI) on Friday showed inflows into small-cap mutual fund schemes came down by 10% to Rs 2,922 crore in February against Rs 3,257 crore in January while redemption in these schemes grew 5% to Rs 3,975 crore last month against Rs 3,777 crore logged in January. Inflows into the mid-cap schemes fell 12% to Rs 1,808 crore in February as against Rs 2,061 crore in January. Systematic investment plan (SIP) inflows reached an all-time high in February 2024, surpassing the Rs 19,000 crore mark for the first time. The SIP assets under management (AUM) for February 2024 stood at Rs 10.52 lakh crore.

Venkat Chalasani, CEO of AMFI, said the recent measures taken around mid-cap and small-cap funds are part of the risk management framework as the ultimate aim of the industry is to protect investors’ interests. He added that the intention of the regulator (Sebi) and the industry is not to stop the inflow into small-cap funds but to enhance disclosure and transparency.

Last month, Sebi told mutual funds (MFs) to frame a policy to protect the interest of investors following a sell-off in small, midcap, and microcap stocks. The AMCs are now required to disclose the results of stress tests for small and mid-cap schemes by March 15 each year. This is expected to improve the risk assessment of investors.

“AMCs shall disclose the results of stress test and liquidity, volatility, valuation and portfolio turnover in respect of mid-cap and small-cap equity schemes, as per the attached format, along with the guidance in simple language, assumptions and methodology, to enable the investor to understand the risk associated with the aforesaid two category of schemes,” stated a recent circular issued by the AMFI.

Viraj Gandhi, CEO, SAMCO Mutual Fund, said that as anticipated earlier, there is a mild sequential moderation in midcap and small-cap funds inflows by 12% and 10% respectively. “Caution was required, caution is advised and caution prevailed by moderation of flows in the segment, though marginally, but a step in the right direction,” added Gandhi.

Gandhi said February was the NFO festival for the industry. There were 20 NFOs, 8 equity-based, which collected Rs 8,692 crore, Rs 1,500 crore came in hybrid schemes and the balance 10 offerings gathered Rs 1,278 crore totalling Rs 11,470 crore. Debt-oriented schemes saw inflows of Rs 63,809 crore led by liquid funds at Rs 83,642 crore and outflows of Rs 17,376 crore from overnight funds.