Merger with Reliance would boost company's profits and reduce risk in India: Disney CEO

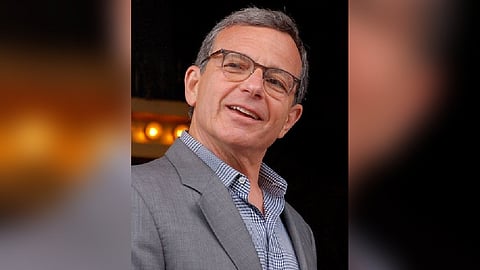

NEW DELHI: Walt Disney CEO Bob Iger has said a joint venture with Reliance Industries after merging its India business would benefit the company in terms of profit and also "derisk" its business in the Indian market.

The merger deal will create a big entity and help it to stay in the market at a "significant level", said Iger at a Morgan Stanley investor conference earlier this week.

"We had an opportunity to align with Reliance, which is obviously the company that has done very well there and one that we respect. And in doing so, end up owning part of a bigger media company. And we believe that, that not only should benefit us in terms of the bottom-line, but derisk us as well there," he said.

Last month, Walt Disney Co. and Reliance Industries announced signing of binding pacts to merge their media operations in India.

Under the deal, Reliance and its affiliates will hold 63.16 per cent and Disney will have 36.84 per cent in the JV, which will create India's leading media company that will house two streaming services and around 120 television channels.

"We wanted to stay in India. We made a big investment in India when we purchased the assets of 21st Century Fox. We are one of the biggest media companies in India. But even though it is the most populous country in the world, we felt we want to be there because of that, we also know that there are challenges in that market," he said.

Iger said, the merger will create a big entity and help it to stay in the market at a "significant level".

"So, it's kind of the best of both worlds. We stay in the market at a significant level. We have a very good partner in Reliance, and we get to have a chance of growing a business and lowering the risk of doing so," he added.

The transaction values the joint venture at Rs 70,352 crore (USD 8.5 billion) on a post-money basis, excluding synergies.

Billionaire Mukesh Ambani-led Reliance has also agreed to invest at closing Rs 11,500 crore into the joint venture to give it the muscle to fight rivals such as Japan's Sony, and Netflix.

Its OTT platform Disney + Hotstar has seen its paid subscriber base decline from around 55 million to 40 million in the first quarter of FY24 because of Reliance's Jio Cinema winning exclusive rights for live sports. The combined entity will have the largest OTT subscriber base.

Disney + Hotstar was launched in India in 2020, post the acquisition of the entertainment assets of 21st Century Fox at a valuation of USD 71.3 billion, thereby taking over the operations of Star India and Hotstar. It housed entertainment and cinema channels such as StarPlus and StarGold as well as sports channels like Star Sports.

While Disney + Hotstar rapidly increased its subscriber base initially with the streaming rights of cricket matches (IPL, World Cup), it lost the bid for the digital streaming rights in 2023-27 cycle, which was won by Reliance-backed Viacom18 for USD 720 billion, 12.92 per cent higher than what Star India had paid on an average per match value.

Media ventures of Reliance are currently housed in Network 18, which owns TV18 news channels as well as a plethora of entertainment (under the 'Colors' brand) and sports channels. NW18 also has stakes in moneycontrol.com, bookmyshow and publishes magazines.

NW18 owns news channels CNBC/CNNNews.

Reliance separately owns a movie production arm - JioStudios, and majority stakes in two listed cable distribution companies, Den and Hathway.