Jefferies Equity Research, the research arm of the global financial services firm, said it remains bullish on India's hotel industry, which has seen its market cap triple in the last three years alongside a 30% surge in RevPAR (revenue per available room) in the past year. In a new report, Jefferies said it expects the sector to continue its strong performance in the current financial year (FY24).

The robust growth in the stock prices in this sector has been attributed to impressive operating performance, earnings surprises, valuation re-rating driven by the domestic travel boom, and three recent IPOs in the space.

"The supportive macro, hotel demand outstripping supply growth, industry focus on pricing, premiumisation, and the travel theme should remain earnings & valuation drivers," Jefferies said.

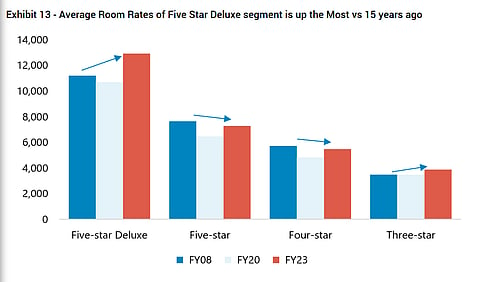

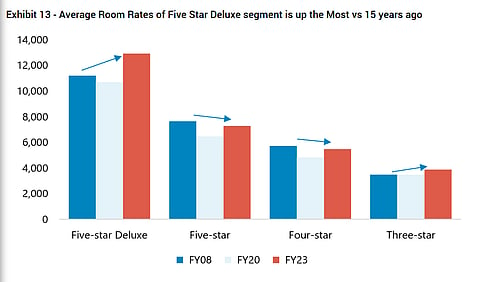

Industry-wide average room rates (ARRs) in CY23 are more than 30% higher compared to pre-COVID levels in CY19, with luxury hotels witnessing the highest growth, reflecting consumers' willingness to pay a premium for high-end experiences.

This premiumization trend aligns with similar patterns observed across various sectors, including smartphones, real estate, automobiles, jewelry, and beauty & personal care, it said.

Although foreign tourist arrivals have not yet fully recovered to pre-pandemic levels, strong domestic travel spending has sustained the sector's growth, it added.

Jefferies expects hotel companies to maintain strong earnings momentum in FY25/FY26, albeit at a slightly slower pace compared to the high growth seen in FY23/FY24.

The report maintains a positive outlook on the hotel sector, supported by the ongoing cyclical recovery and the prospect of new listed players offering exposure to more brands and asset-heavy models. Jefferies believes the sector's valuations will remain buoyant, underpinned by the favorable travel theme, robust domestic tourism, and the premiumization trend.