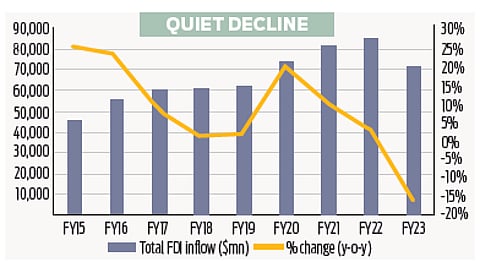

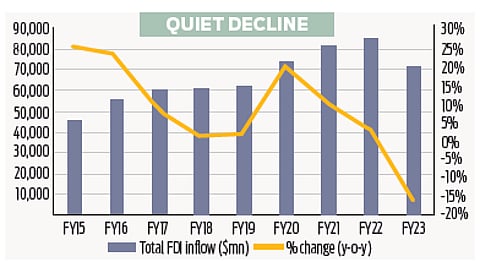

NEW DELHI: The Indian economy is facing a new challenge — slowdown in foreign direct investment (FDI). In 2022-23, FDI equity inflows declined by 22% year-on-year to $46 billion. The year before, the inflows had contracted by a percent.

However, the FDI equity inflow number looks slightly better when reinvested earnings and other forms of capital are taken into account. In 2022-23, the FDI growth declined by 16% to $71 billion compared to a 3% increase to $85 billion in the previous year. In the current financial year till December 2023, the FDI in form of equity inflow was 13% lower y-o-y to $32 billion.

In its recent monthly economic commentary, the finance ministry acknowledged the problem. “Mirroring the slowdown in FDI flows to developing countries, gross FDI inflows to India also dipped but only slightly during April 2023-January 2024. In the 10 months, gross FDI inflows were $59.5 billion compared to $61.7 billion in the same period last year. In net terms, the comparable figures were $25.5 billion versus $36.8 billion,” says the ministry. It also attributed the contraction in net inflows to a rise in repatriation of investment.

However, the rot is deeper than the picture the finance ministry is painting. The slowdown in FDI growth is not a recent phenomenon. The slowdown has been setting in since 2016-17. In the 10-year period to 2022-23, the FDI grew at a CAGR of 6.6% compared to 27% in the previous 10-year period. The FDI (equity inflow, reinvested earnings and other inflows put together) as a percentage of nominal GDP in 2022-23 was 2.1% compared to 2.7% in 2021-22. The highest that India ever achieved was 3.5% in 2008-09. In recent years, 2020-21 saw India’s FDI/GDP ratio touching 3.1% largely due to contraction in GDP.

According to Ritesh Kumar Singh, a corporate economist and a former assistant director of the Finance Commission of India, foreign investors remain hesitant towards India due to uncertainties in tax regimes, bureaucratic hurdles, and difficulties in enforcing contracts. He also cites India’s neglect of free trade deals.