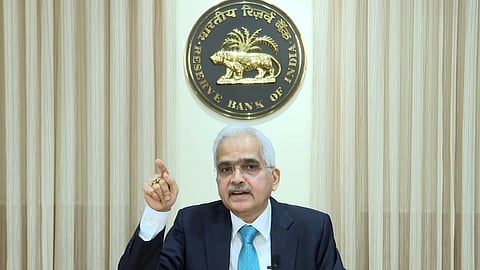

MUMBAI: RBI governor Shaktikanta Das said that an interest rate cut at this stage will be “premature, and very, very risky".

The monetary policy committee had left the interest rates unchanged for the tenth time earlier this month.

"We are not behind the curve. Out growth story remains intact. Our economy is poised to grow at 7.2 percent this fiscal. Growth is steady and resilient, inflation is moderating with certain risks, so a rate cut at this point will be premature and very, very risky," Das said during the fireside chat at an event organised by the news agency Bloomberg here Friday.

While inflation is expected to moderate, Das said there are 'significant risks' to the outlook.

During the October monetary policy announcement, the central bank-led MPC had maintained the status quo on rate but changed the policy stance to ‘neutral' from 'withdrawal of accommodation.'

"It is with a lot of effort that the inflation horse has been brought to the stable, which’s closer to the target within the tolerance band (4 per cent with 2 per cent of leeway either way) compared to its heightened levels two years ago,” the governor Das said in the October monetary policy statement.

“Now, we have to be very careful about opening the gate as the horse may simply bolt again. We must keep the horse under tight leash so that we do not lose control," Das emphasised.

Das further said the developments since the August meeting of the MPC indicate further progress towards realising a durable disinflation towards the target.

"Despite the near-term upsides to inflation from food prices, the evolving domestic price situation signals moderation in headline inflation thereafter", he added.

On inflation, the governor further said, "it is expected to moderate but there are significant risks, the RBI is monitoring the outlook on inflation and growth."

Retail inflation rose to a nine-month high of 5.5 per cent in September after remaining below 4 per cent for the previous two months owing to higher food inflation. The food items constitute as much as 45.9 per cent of the CIP basket.

The steep jump in September was led by a jump in food inflation, which rose to 9.24 per cent in September compared with 5.66 per cent in the previous month. And in the October policy review the governor and his deputy in charge of the monetary policy department, Michael Patra, said they expected the CPI to increase in October as well, due to food prices and base effect, but will begin to ease from November.

The Reserve Bank retained the retail inflation projection at 4.5 per cent for fiscal 2025, with Das stressing that the central bank will have to closely monitor the price situation given the rising risks to imported inflation as crude prices have vaulted over 18 per cent in the past one week following the flare-up war between Israel and Iran.

However, the RBI has retained the CPI projection for FY25 at 4.5 per cent, with Q2 at 4.1 per cent; Q3 at 4.8 per cent; and Q4 at 4.2 per cent. CPI inflation for Q1FY26 is projected at 4.3 per cent.

Going forward, Das said there is a need to closely monitor the evolving conditions for further confirmation of the disinflationary impulses. Retail inflation softened significantly in July and August, with base effect playing a major role in July. Food inflation experienced a certain degree of correction during these two months.

On the rising foreign exchange reserves, the governor said the central bank does not have any specific target for the reserves. The reserves had closed the $700 billion mark earlier this month, making it the world’s fourth largest after China, Japan and Switzerland.

On the rupee, which has been under stress for months now and had plumbed the 84 levels last week, he said the central bank is not managing the exchange rate to bring the rupee to a particular level nor it has a target for the currency.

From January 2022 till now, the rupee has depreciated 11-11.5 per cent against the dollar, which has appreciated during this period by 8-8.5 per cent, Das added.