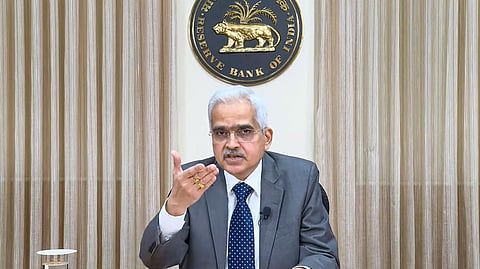

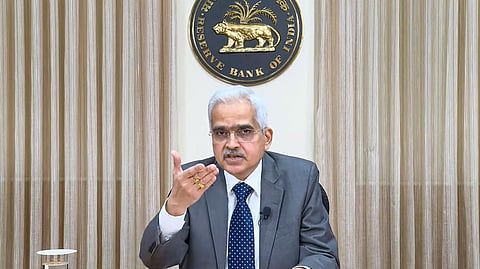

MUMBAI: The Reserve Bank Governor Shaktikanta Das has flagged his concerns about the growing popularity of cryptocurrencies yet again reiterating his position that such instruments are “huge risks to financial stability, and monetary stability” asserting that they may create a situation where the central banks may lose control of money supply in the economy.

"I am actually of the opinion that this cryptocurrencies is something which should not be allowed to dominate the financial system. Because it has huge financial stability risks, it has huge monetary stability risks, it also poses risks to the banking system. It also may create a situation where the central bank may lose control of money supply in the economy," Das said during his appearance at the Peterson Institute for International Economics, a think-tank in Washington on Friday.

Das also told the same gathering that prices have finally started moderating in India but upside risks from unexpected weather-related and geopolitical events, leading to another bout of spikes require added vigilance.

Last week he had said that cutting rates at this juncture would be too premature and very risky, dashing hopes of the markets that had penciled in a 25 bps repo cut in the December policy review. His comments came days after the CPI sot up to 5.65 in September and is likely to be high in October as well.

The governor was speaking as part of the annual meeting of major finance ministers and central bank chiefs’ under the aegis of the International Monetary Fund and World Bank annual jamboree in Washington. The Reserve Bank shared the copy of the speech Saturday morning.

'India was the first country to raise questions about cryptocurrencies'

Das has been a vocal critic of the privately traded default currencies for long and has not changed his strident opposition even after the Modi government made it partially legal by levying taxes on the profit one makes by trading in cryptos.

"If the central bank loses control of money supply, how does the central bank check liquidity available in the system? How does a central bank control inflation by squeezing the money supply or by losing money supply in times of crisis? So, we see crypto as a big risk, and there has to be an international understanding because the transactions are cross-country," the governor said in response to a question.

"There has to be an international understanding on the issue, being fully mindful of the huge risks associated with cryptocurrencies. I feel it should not be encouraged. This view is not a very popular, but I think as custodians of financial stability, it is a major concern for central banks the world over. Governments are also becoming increasingly aware of the possible downside risks in cryptos," Das said.

India was the first country to raise questions about cryptocurrencies long back. At the G20 under the Indian presidency, there was an agreement to develop an international understanding about how to deal with the crypto ecosystem. Some progress has been made in this regard, he added.

"I think more work still needs to be done. From India, from the Reserve Bank's perspective, I think we are one of the first central banks which very clearly voiced its serious concerns about cryptos. We see them as big risks, huge risks to financial stability. There are good reasons why we are saying that," he said.

"First, we have to understand the origin of this type of money. The origin was to bypass the system. Cryptocurrencies have all the qualities of money. But the fundamental question is, are we, as authorities and governments, comfortable with privately issued cryptocurrencies which have all the features of central bank-issued currency. Currency issuance is a sovereign function. So the bigger question is whether we are comfortable with cryptos, which has characteristics of being a currency, or whether we are comfortable with having a private currency system parallel to the fiat currency," he argued.

"Obviously, if a certain part of your economy is getting carved out and it is dominated by the private crypto assets, then the central bank loses control over the entire monetary system, leading to huge instability in the monetary system. It can also promote instability in the financial sector. So there are very big risks," Das said.

"So, therefore, in India, we have been articulating that we have to deal with this very carefully. Of course, it will depend on individual countries taking their own decisions. But we feel that it has to be very strong, it is something which I think should be very cautiously and very carefully dealt with," Das said.

Meanwhile, talking about inflation and growth, Das told the same gathering that prices have finally started moderating but upside risks to another bout of spikes require added vigilance even as the economy is expanding at a solid clip with the balance of growth and inflation well-poised.

"Inflation is moderating in India. But we can't take it for granted," due to upside risks that could arise from unexpected weather that affects crops, geopolitical events and supply bottlenecks,” Das said, adding “Overall, the financial sector remains sound and resilient. But we are certainly not complacent amid a rapidly changing environment."