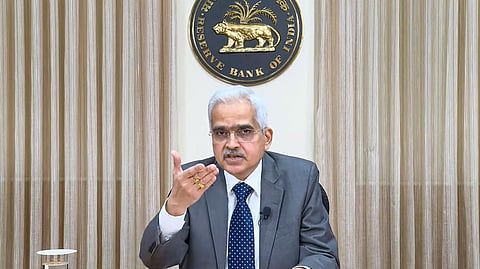

Banks with large commercial realty exposure may be shortsellers’ targets, warns RBI Governor Das

MUMBAI: The Reserve Bank Governor Shaktikanta Das has flagged concerns about banks having large commercial real estate exposures, saying they may be shortsellers’ targets.

The governor also expressed concerns over the proliferation of non-bank institutions in financial intermediation may create systemic risks to financial stability due to their sheer size, complexity and interconnectedness with domestic and global financial systems, as was visible in some advance economies leading to periods of market dysfunction.

“Hidden leverage and liquidity mismatches of these institutions can amplify systemic shocks and propagate strains throughout the financial system," Das warned addressing the third meeting of the Bretton Woods Committee’s future of finance forum in Singapore, Friday.

Warning on the increasing exposure of banks to global commercial real estate (CRE), Das said, “Stress in the global commercial real estate sector needs to be watched closely as banks exhibit high sensitivity to expected and unexpected CRE losses, due to the relatively high CRE coverage ratios in their loan books.”

“Further, liquidity squeezes can materialise for banks with large CRE exposures, as short sellers may target them and investor confidence may slip further,” Das warned. He further advised that staying alert and undertaking forward-looking regulatory measures ahead of the curve can contain the risks to bank balance-sheets and systemic stability.

It can be noted that domestic banks have been increasing their lending to the commercial real estate sector, showing renewed confidence in the market. According to the latest Reserve Bank data released in May, the bank’s CRE portfolio jumped by a huge 22.94 per cent on-year to Rs 3.96 trillion as of March 2024.

Talking on the country’s growth, the governor expressed confidence that the economy has the potential to grow at 7.5 per cent or more, which is a little above the bank's full-year forecast for fiscal 2025 of 7.2 per cent.

"I think India's potential growth today...is about 7.5 per cent-plus. This year, we expect the economy to record 7.2 per cent," Das said and described the slower growth of 6.7 per cent in the first quarter mostly due to low government expenditure during the national elections.

However, he said the improvement in merchandise exports was below expectation as external demand is not as robust as before, though he said services exports have already picked up.

Retail inflation inched up marginally in August to 3.65 per cent from 3.5 in the previous month, fuelled by food and pricier vegetables, but remained below the Bank’s target of 4 per cent, while factory output rose despite high base effect lifted by manufacturing growth, according to the official data released Thursday.

On the fluctuations in the price index, Das opined that "the RBI must stay on course amid sudden dips in India CPI inflation."

On the global financial system, Das said “while several near-term risks appear to have receded, the global financial system continues to face heightened uncertainty from the outer-term outlook. Some of these risks are well known and well acknowledged, but other risks are just emerging or are lurking in the background.

"As macroeconomic conditions diverge in different regions of the world and policy responses get increasingly unsynchronized, spillovers to advanced and emerging economies alike are getting amplified,” he warned and suggested that a flexible and robustly equipped regulatory architecture in the financial sector will be essential to stay ahead of the curve and minimise risks.

Warning on the persistent services inflation, he said this is fuelled by a combination of elevated wage growth and constrained productivity which are placing balance sheets of financial intermediaries at risk from recognised and unrecognised valuation losses.

“The stickiness in services inflation can delay the return to price stability which, in turn, increases external, fiscal and financial risks. In such a scenario, monetary policy management by central banks has to be prudent and supply side measures by government have to be proactive,” he said.

The governor also warned of the rising debt levels in the global economic landscape, saying it has reached $315 trillion or 333 per cent of global GDP in 2024, according to an estimate of the Institute of International Finance.

“At these levels, the debt overhang poses significant spillover risks to emerging economies, in particular, the low income and some middle-income countries are very vulnerable. Coexistence of high levels of debt and elevated interest rates can feed a vicious cycle of financial instability through impairment of government and private-sector balance sheets,” he said noting fiscal deficits or net accretions to debt stocks are higher than pre-pandemic levels now.

On the challenges from climate change which are imparting considerable uncertainty to both growth and inflation trajectories, Das said “inward-looking policies, including trade-distorting measures, can compromise the ability to tackle global challenges like climate change and that climate commitments made by nations must be fulfilled, while adhering to the widely accepted principle of common but differentiated approach.”

On the global financial stability risks, he said despite the resilience in recent months, there has been a sharp increase in prices of relatively riskier assets such as the narrowing of corporate spreads coinciding with rising episodes of corporate defaults. To the extent that valuations are currently stretched, sudden shocks could precipitate stress that spreads contagiously across financial market segments through sell-offs and band-wagon effects.

A strong US dollar increases debt servicing burdens of other nations and their inflationary pressures. To what extent this scenario will get impacted depends on the quantum and timing of policy pivot by the US Fed, following their recent pronouncements to this effect.

The governor also reiterated his concerns over the rising private credit market which has grown fourfold over the past 10 years. “It is now a major source of corporate financing among middle-market companies that have low or negative earnings, high leverage, and lack high-quality collateral.

“Proliferation of this asset class, along with intensifying competition with investment banks on larger deals, may shift supply-demand dynamics and result in poorer underwriting standards. As a consequence, probability of credit losses can rise and make existing risk management models obsolete,” he warned. “Rapid growth of private credit, their increasing interconnectedness with banks and non-banks, and their opacity creates vulnerabilities that can become systemic,” he warned further and called upon regulators the world over to give a closer look to these developments and come out with necessary guardrails.