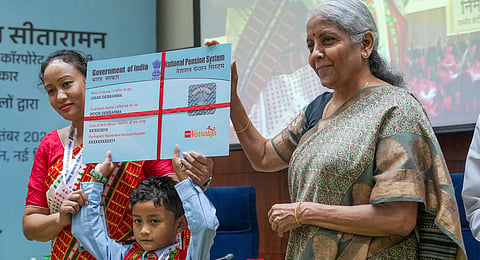

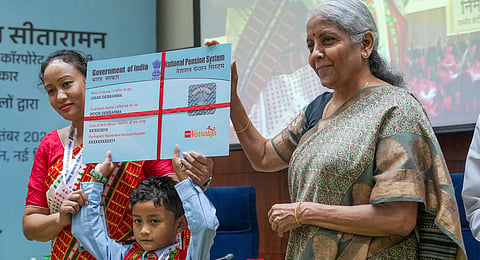

NEW DELHI: Finance minister Nirmala Sitharaman on Wednesday introduced NPS Vatsalya scheme, enabling parents to invest in a pension account for their children. Parents can enrol in the scheme either online or by visiting a bank or post office.

To open a Vatsalya account, a minimum initial contribution of Rs 1,000 is required, followed by an annual contribution of Rs 1,000. “NPS has generated very competitive returns and offers option to people to save while ensuring future income,” Sitharaman said.

This saving-cum-pension scheme is regulated and administered by the Pension Fund Regulatory and Development Authority (PFRDA) and is designed to allow parents to invest in a pension account for their minor children. All Indian citizens below the age of 18 are eligible for the NPS Vatsalya scheme.

An account can be opened in the name of the minor, but it must be operated by a guardian, ensuring that the minor is the sole beneficiary of the funds. Parents can easily open the NPS Vatsalya account either online or through physical channels, including major banks and India Post, all of which are registered with PFRDA. A list of Point of Presence (POPs) can be accessed on the PFRDA website.

Account Opening Requirements

To open an NPS Vatsalya account, guardians must provide proof of the minor’s date of birth, which can include documents like a birth certificate, school leaving certificate, or passport. Additionally, the guardian must submit their KYC documentation, including proof of identity and address such as Aadhaar or a driving licence.

A Permanent Account Number (PAN) or a Form 60 declaration is also required. For guardians who are non-resident Indians (NRIs) or overseas citizens of India (OCIs), a NRE/NRO bank account for the minor is necessary.