MUMBAI: RBI governor Shaktikanta Das said the biggest threats to central banking in future will be from climate risks and the over-permeation of technology in the financial services space.

He also pointed out that as pre-eminent macro-financial policy institutions, central banks have to keep reinventing themselves in tune with the challenging times by anticipating future risks and undertaking suitable pre-emptive measures to avert or mitigate potential risks.

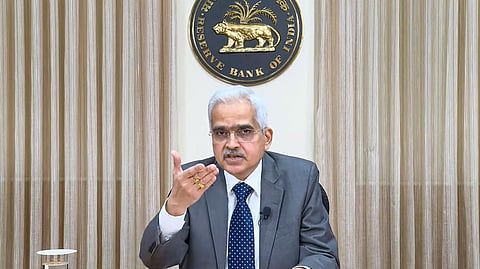

Delivering the first Himalaya Shumsher Rana memorial lecture on ‘Central banking in the 21st century: changing paradigm,’ Das said among the many challenges that could significantly impact the central banking landscape in the 21st century “the first and foremost is climate change, which is emerging as a huge challenge. It can become a systemic risk, if not addressed in time.

"Severe climate or weather-related events which are becoming more frequent and intense can impact central bank’s core mandates of price and financial stability by causing sudden price pressures, damaging infrastructure, loss of economic activity and stress on fiscal balances. They can also impact the balance sheet of banks and other lenders," he warned.

According to Das, the second major challenge relates to the advent of artificial intelligence and machine learning tools in financial services.

“While its application and usage in central banking and financial services have tremendous scope, it also poses challenges of data privacy, algorithmic bias and discrimination, cyber security and ethical issues,” he said stressing the the need for central banks to enhance their own capacities to deal with these challenges.

He also said that challenge also comes from technology in terms of fintech innovations. "Emerging challenges for central banks in this journey is to steer digital innovation towards a more efficient, prudent and stable financial system, reaping the benefits of digital financial infrastructure while further building on their track record as trusted safe keepers of price and financial stability," Das said.

“Central banks will also have to deal with issues of regulation and supervision of digital lenders; observance of fair practices code by stakeholders; data security and privacy; and third-party service providers etc,” the governor added.

He also listed the continuing geopolitical disturbances and geoeconomic fragmentations as daunting challenges to central banks.

“Experience of the past few years shows that the journey ahead may be marked by dynamic shifts in geopolitics, with frequent incidences of supply chain disruptions and greater barriers in trade, technology and capital flows. These will be the new sources of shocks, often not well captured in existing macroeconomic models,” he said.

Summing up the challenges, he said, “While climate change and geopolitics may work as supply shocks to fuel inflationary pressures and slowdown global growth and trade, innovation and artificial intelligence, if well supervised and properly channelised, can help in enhancing productivity and reducing costs. The net effect will depend, to a great extent, on central banks’ own capabilities in harnessing the potential while managing the transition. This in turn will determine the financial landscape of the 21st century.”

On the importance of price and financial stability, he said “The foremost lesson from the recent crisis is that strengthening one’s fundamentals is the best buffer against global spillovers in today’s uncertain world.

At the same time, he warned that financial stability measures via extraordinary monetary expansion, if not corrected in time, can risk price stability.

It is, therefore, evident that the relationship between price stability and financial stability runs in both directions and the impact depends on the policy choices we make. On the other hand, financial stability measures aimed at effective regulation and supervision of banks, non-banks and markets can enhance monetary transmission and help price stability.

Sometimes, the pursuit of price stability can be in conflict with financial stability as experienced recently by some advanced economies when tighter monetary policy raised concerns about the banking system stability. The trade-off between price stability and growth emerges when the pursuit of price stability entails large growth sacrifice.

It is, thus, important, that central banks employ their multiple instruments such as monetary policy, macroprudential regulation and micro-prudential supervision in an optimal manner to reduce such trade-offs and achieve better outcomes for the economy.

Recent experiences have underscored the importance of monetary-fiscal coordination for better economic outcomes and pointed to the ones taken during the pandemic, wherein central banks worked in close coordination with governments to deal with the unprecedented crisis.