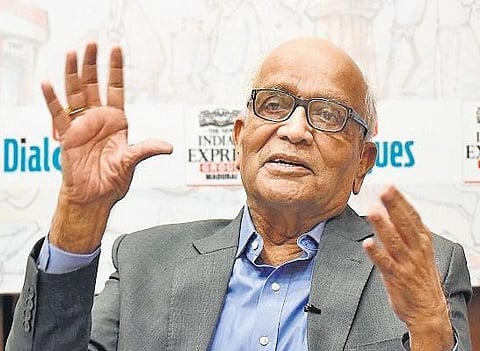

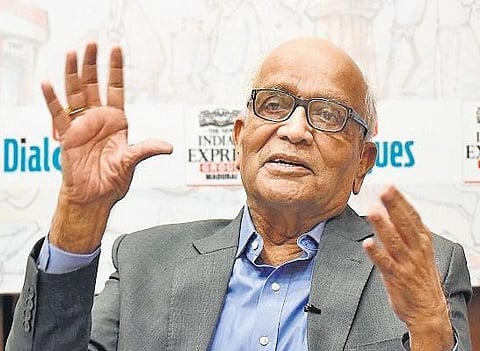

Maruti Suzuki India (MSIL) Chairman RC Bhargava stated on Friday that the majority of Indian consumers cannot afford passenger vehicles (PVs) due to low household incomes. Citing income data, he highlighted that only 12% of households earn more than ₹12 lakh annually, making them the primary segment capable of purchasing cars priced ₹10 lakh and above.

“If you look at household income data, you will find that 200 million households out of 300 million have income below $6000 per year…Only 12% of households have income above Rs 12 lakh ($14,000). So to buy a car costing Rs 10 lakh plus, you will have to be in this household category and therefore car buying in India is largely restricted to this 12% of households,” said Bhargava on the sidelines of MSIL’s Q4FY25 earnings announcement.

He further stated, “How can you have high growth if 88% of the country are below levels of the income who can afford a car costing Rs 10 lakhs and above. The cheaper cars have become unaffordable because of the high cost of implementing regulatory measures.”

After growing at just 2.6% in FY25, domestic PV sales are expected to grow at just 1-2% in FY26, as estimated by industry body Siam. The sale of small cars in India fell by 9% in FY25 and is expected to remain under pressure this fiscal as well.

Bhargava rejected the notion that shrinking small car sales stem from consumer preference for SUVs, calling it a "fallacy." He clarified, "People aren't abandoning small cars -- they simply can't afford them." Highlighting India's low car penetration (34 per1,000 people), he noted that the current 2-3% annual growth rate won't significantly improve accessibility.

To reduce dependency on the domestic market, the country’s largest carmaker is expanding its presence in the global market. MSIL expects its exports to grow by 20% in FY26.

“We are doing better because exports have been good. We are now 43% of domestic exports. We will try to increase our exports by 20% in FY26 and that is going to be the main driver of our total production, total sales and profit. The domestic market growth, unless something changes, will remain muted,” said Bhargava. The carmaker has kept a capital budget of Rs 8000-9000 crore for FY26.

MSIL reported a decline of 1% in its net profit at Rs 3,911 crore in Q4FY25 compared to Rs 3,952 crore in Q4FY24. Total revenue from operations for the fourth quarter increased by 6.4% to Rs 40,920 crore from the year-ago period's Rs 38,471 crore.

The company sold 2,234,266 vehicles last fiscal, including 1,901,681 units in the domestic market and 332,585 units in the export market. Maruti Suzuki also said that sales of its first electric vehicle, e Vitara, will start in India before the end of September 2025. Maruti will produce nearly 70,000 units of this EV brand in FY26 and a large chunk will be for the export markets. MSIL will also launch a new SUV later this year.