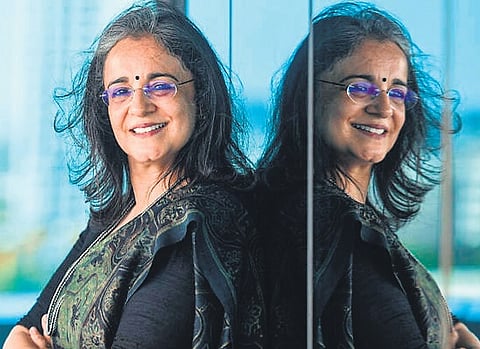

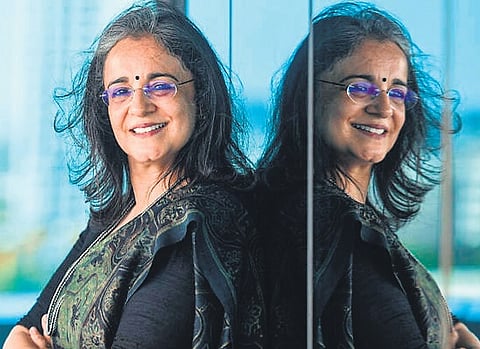

MUMBAI: When Madhabi Puri Buch, the first woman and also the person from the private sector to become the chair of the markets watchdog Sebi, walks out of the corner room of the Sebi Bhawan in BKC on Friday, she will also be leaving something else to history—the most controversy-ridden and tumultuous three years for the regulator in its 38 years of existence. But to be fair to her, Puri-Buch has had more hits than misses when it comes to regulatory achievements which she continued to discharge even after being hit by the volley of allegations that the New York-based short-seller Hindenburg charged her and her husband Dhaval with in the August 2024.

Apart from the controversy, the tenure of Puri-Buch, who was appointed as the 12th chairperson of the Securities and Exchange Board (Sebi) on February 28, 2022 for a three-year term, was also marked by a sharper focus on enhancing market integrity, investor protection, and regulatory efficiency and extensive use of technology. Her prior experience as a whole-time Sebi member helped in framing more regulatory frameworks during her chairpersonship wherein she continued to advance the regulatory mission, emphasising reforms to improve market transparency, improving ease of doing business and strengthening investor confidence.

As the chairperson, Puri-Buch also let a situation to develop and come out wide open wherein the very efficacy of the Sebi was in doubt and not just her own personal integrity. Never in its 38-year history Sebi was under so much cloud as it was under her.

Many insiders say that she could not secure a second term despite her many achievements has more to do with politics than the Hindenburg allegations against her and her husband because letting her go following the allegations would have been an admission on the correctness of the allegations against Adani group and its cozy relationship with the top echelons in the government. They further say that she is more of a victim of the IAS lobby’s scheming than her personal failings as alleged in the Hindenburg report which also accused her conflicts of interests and excessive control over the Sebi staff.

Regulatory Gains

One of her biggest gains as the regulator is taming the bull-run in the derivative space by retail investors, despite stern opposition from the market. Sebi’s own studies have found that retail investors were heavily losing, collectively to the tune of Rs 60,000 crore per annum or over Rs 1.25 lakh per investor. Since the curbs came into force from November 2024, the futures & options volume has crashed by more than 50%.

Another gain is the orderly growth of the market along with the mutual funds the hallmarks of which could be huge gains made in the IPO market as well as the Rs 250 SIP which effectively satchetised retail investment into systematic investment plans.

Buch also pushed ahead with cleaning up brokers when it comes to hidden charges and accessing clients funds and stocks. She was so adamant to get the brokers clean themselves up that last March she had said at a public forum that “Sebi will allow another Karvy-like situation only over their dead bodies.” Karvy took place when she was whole-time member and while in the corner room, she ensured that norms are tightened to make almost impossible for other brokers to do an encore of what Karvy did—accessing client funds and stocks.

Another measure was to increase transparency by directing exchanges to charge brokers uniformly irrespective of their volumes or nature of their service—full service or discount. The move had hit badly the latter as they were riding on the low fee offering.

Continuing to remain focused on ease of doing business, Pusi-Buch ensured that promoters who want to access the market for fund-raising could do so with much ease by approving rights issues faster—within 20 days from the earlier 165 days. This came in despite strong opposition from merchant bankers who lost their business as shorter rights issue timing has eliminated the very need for their services.

Her mantra was simple: as the regulator it’s their duty to respect the funding need of a promoter/issuer in a time-bound manner because unless the money is at hand when it is needed, it has no value.

Buch, who has been speaking at industry/public fora regularly even after the Hindenburg charges, would never read out a speech but deploy power points with full of data to drive home her points. So, deploying technology in the decision-making processes of Sebi has been one of her key focus areas. For instance, Sebi now employs artificial intelligence in all its operations including market surveillance and recently she said as much as 89% of the IPO screening process is done by an AI tool internally developed by the Sebi.

Regulatory Misses

The case against NSE in the colocation issue wherein Sebi under Buch told SAT that it could not make out case at all against the exchange or its previous management led by Chitra Ramakrishna of misuse and market dominance using preferred access to some brokers for a fee to its server location, was the biggest slap on its face when it comes to punitive regulatory actions—of course Sebi has never won a serious case so far, barring its case against the Sahara group for its unauthorized fund collection. But Sebi has never gone to the court or the appellate body in its 38 years sating that there was no case at all in the first place!

Another big miss was her inability to close the Supreme Court ordered Sebi probe against group companies after the same Hindenburg had in January 2023 had alleged that the third largest business group was into rigging share prices and round-tripping funds and many other unfair practices.

Similar was the public protest by senior Sebi staff after the Hindenburg allegations came to light which had also charged her with conflict of interest when it comes to certain Sebi orders against companies with which her husband has had commercial relationships or non-disclosure of her private income or her own private fund house among others.

Seems she buckled under the pressure of the MF lobby and also the government to put on the backburner a proposal from her predecessor Ajay Tyagi to slash the expense ratio of mutual fund distributors. The pressure was so much Sebi has called for a new discussion paper on the subject.