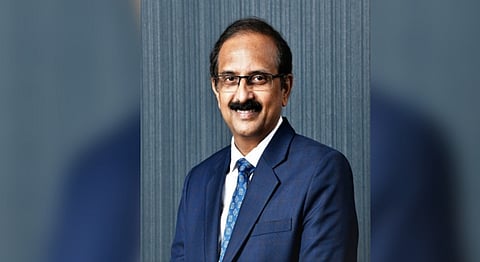

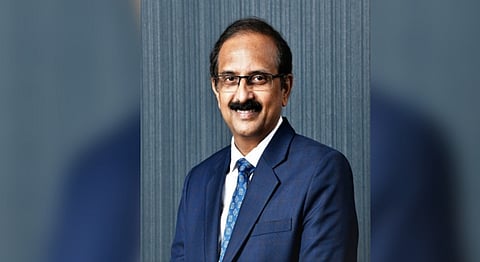

There is an urgent need to develop a common mechanism to track the use of funds raised through debt and equity from capital markets by small and medium enterprises (SMEs). This would provide reassurance to lenders and investors, and make pricing more competitive, said State Bank Chairman CS Setty, speaking at a markets event in Mumbai organised by the Securities and Exchange Board of India.

In recent years, fintech and banks have started to dig deep for credit information from publicly available data and use analytics to create a credit profile for all borrowers, especially the borrowers from the small and medium enterprises. There is a need to formalise and collate all these disparate sources of information and create a repository to enable investors to make informed decisions, Setty said.

Bankers say small units are mostly managed by individuals or families thus lacking a broader decision making and risk assessments, leading to a weaker distinction between the operations of business and household accounts. This raises questions about the diversion of funds and makes assessments about repayment capability in times of stress.

“We will require a viable mechanism to track the actual use of the funds being raised to ensure that the funds are utilised for the purposes they have been raised for,” Setty said in his keynote address.

Setty said the market regulator and stakeholders could probably establish a separate market infrastructure institution with powers to track the end use of the borrowed funds or the funds raised through equities.

Referring to credit decisions about SMEs, he said a big challenge in providing credit to such units is the lack of timely credit information and the information asymmetry created.

“There are a lot of data points which are available now, whether the goods and services tax e-way bills or the credit bureau data, which is making lending to MSMEs to that extent much easier now. These data points will help in structuring equity offerings,” he said.

MSMEs already contribute almost one-third of the national GDP and account for 40 percent of exports. Most importantly, they are also a major employment generator in the economy, Setty said.

The chairman also flagged emerging issues of climate finance and green transition. The annual green financing requirement can be about 2.5 percent of GDP to address the infrastructure gap created by climate events. This could increase if a faster carbon emission reduction goal has to be pursued than what is committed under the nationally determined contributions under the UN framework convention on climate change, he said.

The national council on energy, environment, and water has estimated that the country needs a cumulative investment of $10.1 trillion needed to meet net-zero commitments by 2070. Of this, $8.4 trillion is required for power sector transformation alone, he added.