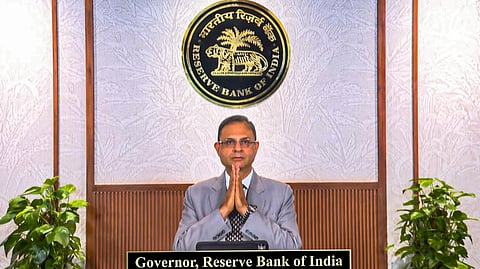

NEW DELHI: The transmission of interest rate cuts typically occurs with a lag, but this time it has been faster," RBI Governor Sanjay Malhotra said during the post-monetary policy press conference. The RBI announced a 50 basis point cut in the repo rate on Friday, following the conclusion of its three-day Monetary Policy Committee meeting

Malhotra acknowledged that while the central bank has frontloaded monetary easing to support growth, the transmission of rate cuts to the broader economy remains uneven and subject to time lags.

He explained that the pass-through of policy rate changes is quicker on the lending side, particularly for loans linked to external benchmarks. “About 45% of our loan book is linked to external benchmarks, and the transmission there is immediate,” he said. However, the deposit side remains more rigid, with no formal mechanism to mirror repo rate changes instantly. “Despite that, we have already seen a 27 basis point transmission on the deposit side following a 25basis point cut in February,” the Governor noted.

Malhotra acknowledged that monetary transmission typically occurs with a lag of six to nine months, based on past easing and tightening cycles. “It will happen this time too,” he said, adding that initial signs are already visible.

Providing data to support this, Malhotra said the average deposit rates have declined by 27 basis points, while lending rates on outstanding credit have come down by 17 basis points. However, the cut on fresh loans has been a modest six basis points, indicating some inertia in banks’ repricing of new credit.

Malhotra termed the current pace of transmission “better than in past cycles,” but emphasized the need for faster pass-through. “That’s why we have frontloaded some of our actions,” he said.

With the policy stance now shifted to “neutral” and inflation projected at 3.7% for the current fiscal, the RBI signaled a data-dependent approach ahead, while encouraging quicker alignment by banks to its monetary signals.