MUMBAI: Finance minister Nirmala Sitharaman has defended the massive write-offs of bad loans by banks (to the tune of Rs 16.35 trillion in the past 10 years) saying bad loan write-offs do not mean waive-offs and that banks are empowered legally to chase the defaulters and recover the money.

Since the insolvency and bankruptcy regime has come into force in May 2016, banks’ bad loan pile has come down massively—from around 13% in FY14 to a low of 2.5% in terms of gross NPAs and over 4% in net NPAs to a low of 0.65% as of December 2024. But this has come at a huge cost to banks as the recovery through the bankruptcy route has only averaged at 32% in all these years.

In FY24, banks wrote off Rs 1.70 trillion, down from Rs 2.16 trillion in the previous fiscal, taking the overall write-offs to staggering Rs 16.35 trillion in the past 10 financial years, the finance ministry has informed the Parliament earlier this month.

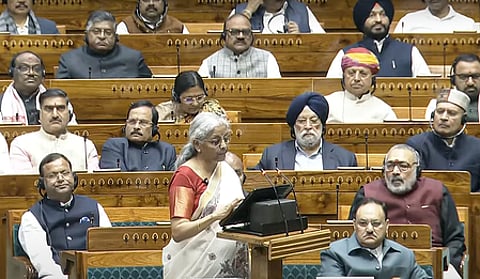

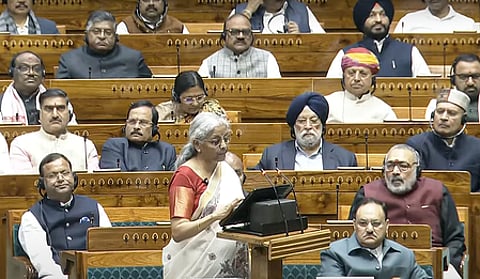

Defending the write-offs as means to clean the books of banks, she said during a debate on the Banking Laws Amendment Bill, 2024 in the Rajya Sabha on Wednesday, “bad loan write-offs don't mean waive-offs. Also write-offs don’t benefit a borrower as it doesn't result in waiver of liabilities.”

Despite massive drop in bad loans, the government is committed to taking stringent action against willful defaulters, Sitharaman said, and pointed out that during the past five years alone, the Enforcement Directorate has taken up around 112 cases related to bank frauds, including those pertaining to willful defaulters.

The improvement in the balance sheet has led to public sector banks posting their highest-ever profit of about Rs 1.41 trillion last fiscal, she said and exuded confidence that the profitability would further increase in FY26.

On the Banking Laws Amendment Bill, 2024 which was passed by the Rajya Sabha by a voice vote Wednesday (the Lok Sabha had passed it in the winter session in December) she said the efforts of the government have not been restricted to structural reforms alone.

“We’ve deepened financial inclusion, took banking to the last citizen, and ensured a citizen-centric banking interface. Over 55 crore Jan Dhan accounts have been opened, of which over 55% are held by women; and over 66% are in rural/semiurban centre branches,” she said.

She also said over 50 crore loan accounts have been sanctioned under the Mudra scheme, and more than 47 crore enrolments have been done for accidental insurance cover under the Suraksha Bima Yojana and when it comes to life cover the number is over 21.67 crore enrolments while the number of subscribers of the Atal Pension Yojana has crossed 7 crore.

The new banking laws that allow a bank accountholder to have up to four nominees, including simultaneous nominations for cash and fixed deposits. It also brings in a number of changes that will improve governance at banks, increase protection afforded to customers/depositors as well as enhance the ease with which a customer interacts with banks.

Another key change in the Bill relates to redefining the term 'substantial interest' of a person in a bank. The limit is sought to be enhanced to Rs 2 crore from the current Rs 5 lakh, which was fixed almost six decades ago. Sitharaman said even though bad loans in the banking system have come down drastically, the government is committed to taking stringent action against willful defaulters.

During the past five years alone, the Enforcement Directorate has taken up around 112 cases related to bank frauds, including those pertaining to willful defaulters.

In response to the Opposition charge that NPAs have come down as banks have written off trillions of rupees (over Rs 16.3 trillion in the past 10 years, the house was informed during the first leg of the budget session), she said, "write-offs do not mean waiving off loans", and the banks will continue to make efforts to recover the funds."

She said public sector banks have posted their highest-ever profit of about Rs 1.41 trillion last fiscal, and exuded confidence that the profitability would further increase in FY26.

The bill also seeks to increase the tenure of directors (excluding the chairman and whole-time director) in cooperative banks from eight years to 10 years, to align with the Constitution (97th Amendment) Act, 2011. Now a director of a central cooperative bank can serve on the board of a state cooperative bank.

It also seeks to give greater freedom to banks in deciding the remuneration to be paid to statutory auditors.The amendment is also aimed at redefining the reporting dates for banks for regulatory compliance to the 15th and the last day of every month instead of the second and fourth Fridays.

According to the amendments, while simultaneous nomination will be permitted for cash and fixed deposits, when it comes to lockers, only simultaneous nomination is allowed. This is already being used in insurance policies and other financial instruments.

She also said over 50 crore loan accounts have been sanctioned under the Mudra scheme, and more than 47 crore enrolments have been done for accidental insurance cover under the Suraksha Bima Yojana and when it comes to life cover the number is over 21.67 crore enrolments while the number of subscribers of the Atal Pension Yojana has crossed 7 crore.