NEW DELHI: The value of banknotes in circulation to GDP ratio continues to see a decline as the same fell to 11.11% in FY25 compared to 11.5% in FY24, according to the RBI annual report. The value of banknotes in circulation to GDP ratio was 12.5% two years ago in FY23, indicating the success of digital payments in the country.

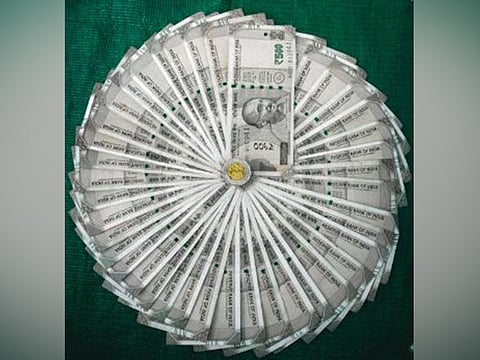

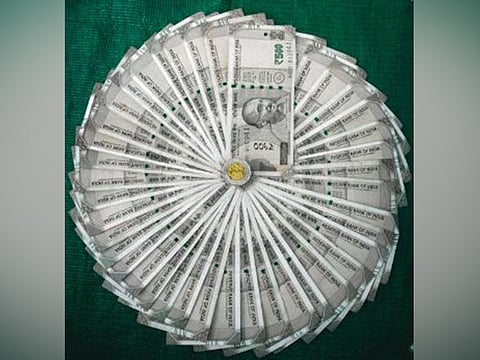

The value of banknotes in circulation increased by 6% in FY25 to Rs 36.88 lakh crore compared to Rs 34.78 lakh crore, as per the RBI Annual Report which was released on Thursday. According to the Reserve Bank of India’s (RBI) Annual Report for 2024–25, currency in circulation—including banknotes, coins, and digital rupee (e₹)—continued to expand, driven by demand for cash alongside growing adoption of digital alternatives.

The value and volume of banknotes in circulation grew by 6.0% and 5.6%, respectively, during 2024–25. ₹500 notes dominated the currency landscape, accounting for 40.9% of all notes by volume and 86% by value, followed by ₹10 notes in volume terms. Despite the rise in cashless payments, lower denomination notes like ₹10, ₹20, and ₹50 still made up nearly a third of all notes by volume.

The withdrawal of the ₹2000 note gained further momentum, with 98.2% of the ₹3.56 lakh crore originally in circulation returning to the banking system by March 31, 2025. The RBI has stopped printing ₹2, ₹5, and ₹2000 notes, signaling a shift toward more frequently used denominations.

India’s central bank digital currency (CBDC), the retail e₹, witnessed an exponential 334% increase in value in circulation to Rs 1,016 crore in FY25 compared to Rs 234 crore in the previous year. Total share of e-rupee remains minuscule compared to physical currency, underscoring the early stage of its adoption.

Despite headlines about India going “cashless,” the RBI’s data tells a story of coexistence rather than competition between cash and digital payments. The surge in Unified Payments Interface (UPI) usage, and the rise of e₹, are being balanced by a consistent public demand for physical currency.