Ahead of the planned demerger of its ice cream business, Kwality Wall’s (India) Limited (KWIL), Hindustan Unilever Limited (HUL) has disclosed KWIL’s strategy to dominate India’s fast-growing ice cream market, which is projected to reach $4.4 billion (over Rs 36,000 crore) by 2030. This ambitious plan was detailed in an investor presentation. HUL has set December 1, 2025, as the effective date for the Kwality Walls demerger scheme.

A market ripe for expansion

The Indian ice cream market is currently valued at $2.6 billion (Rs 21,000 crore) and is forecasted to grow at a robust 11% Compound Annual Growth Rate (CAGR), according to Euromonitor International data. This growth is driven by strong structural tailwinds such as low per-capita consumption relative to global standards; vast under-penetration of retail outlets selling ice cream and rising refrigerator ownership in Indian households.

KWIL highlights a massive expansion opportunity. While India boasts 13 million retail stores, and 4-5 million sell carbonated drinks, only about 1.2 million currently sell ice cream. With KWIL present in only 200,000 of these stores, the company sees significant potential for distribution growth.

KWIL's strategic playbook for leadership

KWIL, which currently claims the title of India's second-largest player by retail sales value, has a clear vision to become India’s No. 1 Ice Cream Company. (Some reports suggest it is the third largest behind Amul and Baskin Robbins). The company outlines four major strategies to stay ahead of the competition:

Winning on price points: The major focus is aligning its portfolio with key snacking price points (Rs10 to Rs 50), where the majority of the Indian snacking market thrives. This involves launching new products and re-pricing existing ones (sticks, cones, Cornetto) to directly compete with popular snacks like chocolates and biscuits.

Massive distribution network expansion: KWIL plans to significantly expand its cabinet fleet, aiming to place ice cream freezers in millions more stores. The company estimates a potential to expand into 3 million additional stores, dramatically increasing product availability.

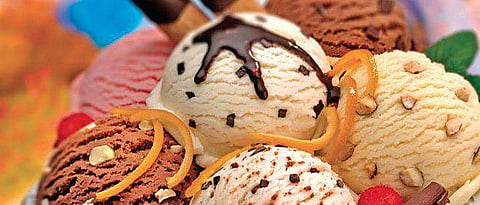

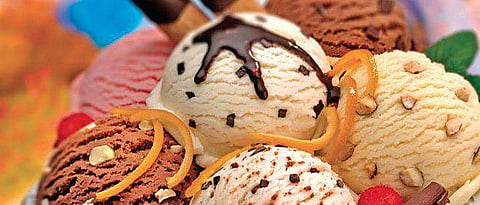

Premiumisation with global brands: KWIL will continue pushing premium brands like Magnum and introduce other international labels such as Ben & Jerry's and Breyers to cater to the growing demand for indulgence.

Riding the Q-commerce wave: The company noted the rapid growth of its e-commerce business, which has climbed from a negligible share to over 10% of its business between FY20 and FY25, powered by quick-commerce platforms that create new consumption occasions.

KWIL acknowledged recent financial pressures, attributing a drop in its H1 FY26 EBITDA margin to 4.5% (down from 7.1% in FY25) to cost inflation and investments.

However, the company outlined a clear value creation model aimed at robust margin improvement through a combination of premiumization, procurement productivity, supply chain efficiencies, and operating leverage. The medium-term plan is to deliver market-beating organic sales growth and steady EBITDA expansion from 2026 onwards.

The separation from HUL is positioned as a mutually beneficial strategic move. For KWIL, it allows for a specialized operating model tailored to the unique cold-chain snacking category, a dedicated investment strategy, and incentives focused purely on ice cream growth.