Indian equity markets started Wednesday with a notably subdued tone, reflecting the cautious mood among traders as buying momentum cooled after recent gains and uncertainties in key sectors lingered. Early trading saw the benchmark indices trading marginally lower or near flat, punctuating a pause after the modest recovery observed over the past couple of sessions.

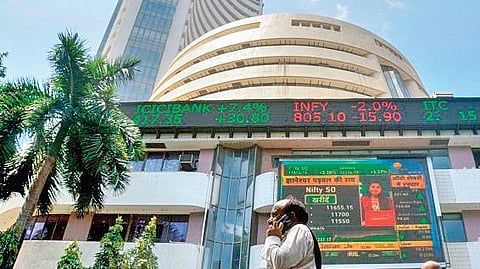

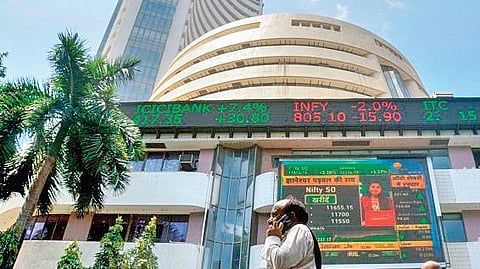

At around mid-morning, the BSE Sensex was hovering near the 83,200-83,400 level, registering a small decline (124 points down) from Tuesday’s close.

The Nifty 50 index was drifting around the 25,660-25,700 zone, a modest dip that snapped the two-day rally seen earlier in the week. The information technology segment was under particular pressure, with the broader IT index retreating more than other sectors and dragging heavyweight IT names lower. This corrective trend in tech stocks was one of the main factors keeping sentiment in check in early trade.

Market participants had looked for steadier momentum following Tuesday’s rebound, when the Sensex and Nifty climbed and put in gains supported by selective sector strength. Analysts had noted that if Nifty could sustain above the mid-25,700s, upside towards the upper end of the 25,900–26,000 range might be possible in the near term. However, the early session softness in IT counters acted as a headwind, limiting broader buying interest. There were some pockets of support, particularly in metals and certain PSU banking stocks, which helped prevent a sharper slide and showed how flows into defensive or cyclical areas were balancing the negative undercurrents in technology.

“A renewed selling pressure in IT counters –following the prior session’s technical rebound–is capping broader gains and weighing on overall index performance. However, the ongoing India AI Summit is reinforcing structural optimism around AI, technology, and infrastructure themes,” says broking firm Enrich Money CEO R Ponmudi.

Beyond the immediate price action, broader market themes have been shaping investor behaviour. The IPO market has remained relatively quiet so far in 2026, with fewer new listings and reduced risk appetite from some corners of the investor community. This hesitancy at the front end reflects a wider recalibration of expectations after sharp moves in selective segments earlier in the year. At the same time, domestic macro forces such as stable inflation, steady corporate earnings in parts of the market, and robust structural growth stories continue to underpin a neutral to cautiously optimistic longer-term backdrop.

Technical traders are noting that the market appears to be forming a base around current support levels, but decisive confirmation above previous short-term highs will be needed before a more confident bullish stance can re-emerge. In the meantime, the early session on February 18 was characterised by range-bound trading, selective stock action and a cautious tone, as participants wrestle with mixed cues from local earnings, sector rotation and global market sentiment.