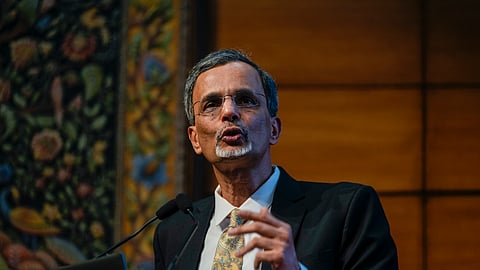

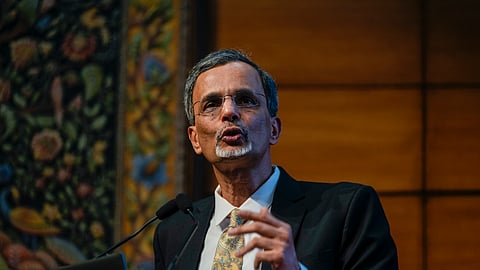

India’s Chief Economic Advisor (CEA) V Anantha Nageswaran said on Thursday that years of ultra-loose monetary policy have resulted in a very expensive stock market.

“The problem is this era of easy money, which was there from 2008 onwards and also resulted in high inflation in 2022 and 2023, has resulted in a very expensive stock market almost reaching the highs before the tech bubble burst in March 2000,” the CEA said while speaking at the Economic Survey 2026 press briefing.

He added that concentration of risk is even more now than what we saw earlier in terms of a few companies having a very high market cap and financing of the global financial capital coming from non-banking sources rather than from banking sources which are better regulated.

“If you look at the circular financing that characterizes many of the AI related investments, you will understand that this can be a sort of a trigger to unravel the global finances,” said Nageswaran.

The CEA pointed out that the price-to-earnings ratio of the S&P 500 (US equity market benchmark) is close to a 26-year high, indicating that stock prices have moved far ahead of long-term earnings trends. He said that such stretched valuations make markets vulnerable to sudden corrections.

Nageswaran's warning comes even as India’s stock market is witnessing a meltdown amid global uncertainty, FII outflows and concerns of expensive valuations following a 3-4 year rally post the Covid-19 pandemic.