BENGALURU: The smarter we are, the dumber we get. The happier we are, the sadder we get. We live in contradictory times, when Artificial Intelligence is taking over the world, and natural intelligence is going into hibernation. As part of the generation that has straddled diverse eras in a few decades – analogue watch to smartwatch – the change is befuddling. But let me assure you, we have transitioned with elan.

We ushered in the 2-minute noodle revolution, and have survived to match the swipe-left-swipe-right Insta generation, pout for pout. But where money matters are concerned, we remain suspicious and cautious, quite a contrast to their easy come-easy go casualness.

The reason lies in our distant past when we had to walk a formidable path to access (our own) money. When a trip to the local neighbourhood bank to withdraw cash was a planned expedition, rushing through morning chores to join the ‘token’ queue. If ‘bank work’ involved updating passbooks and getting a new chequebook (of 10 leaves only), it could take the better part of a day and meant taking leave from work.

It was always better to take along a sibling or friend, or even a book, just in case your wait stretched through the sleepy lunch hour. After scrutiny by a bank official, your cheque slowly moves to the teller, who would eye you and your signature suspiciously before counting out the kingly sum of Rs 1,000 or some more, which would see you through the next two or three weeks. But there was no fear of losing that hard-earned money; bank accounts were as safe as Fort Knox, though they held precious little.

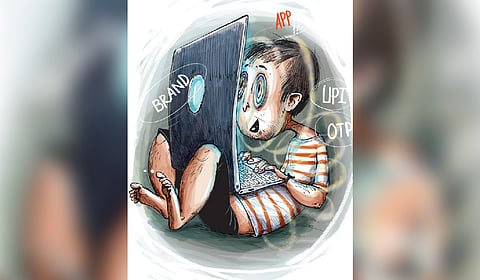

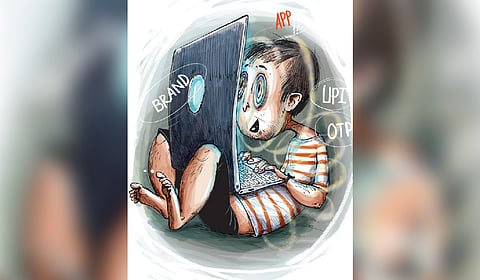

Then came private banks with their ATMs and natty executives in AC cubicles, offering ‘single-window service’ and making the customer feel royal. Now the single window has shrunk to an app. No need to stand in queues, or sit in cubicles, the bank is a faceless entity, and the customer a UPI ID. For smart Gen Z, money has virtually reached home. A generation unscarred by demonetization.

It barely knows what currency notes look like and is wary of handling real cash, but is ready to pay platform fee, surge fee, delivery charge, and other cesses. The app, I say, is the culprit. Apps have brought home other things too – supermarkets, luxury brands, gourmet foods, lunch, dinner, and even the con artist.

As I watch youngsters furiously typing UPI pins and OTPs, I wonder what’s leaking out, and who is waiting to wipe their accounts clean. Call me a hoary doomsayer, but if they don’t step out into the street, when will they get street-smart?

(The writer’s views are her own)