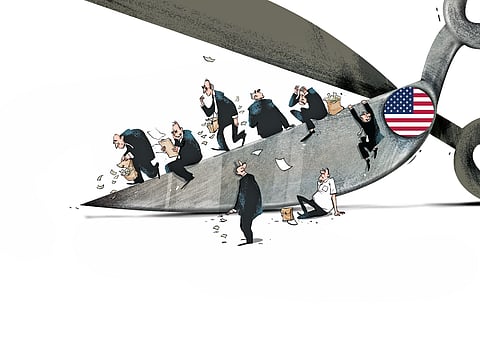

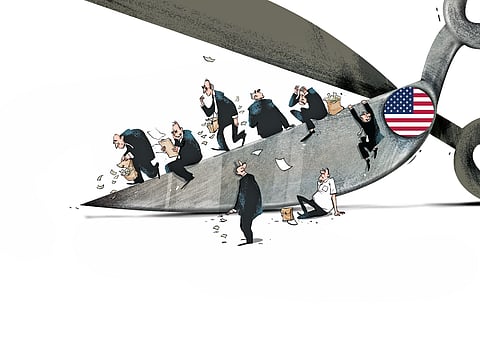

Donald Trump has shaken many a boat with his quirky policy making in a short span of his second term as US president. He plays to the gallery and targets everyone he and his voters think comes in the way of the Make America Great Again (MAGA) dream.

His primary nemesis to his MAGA dream is the ‘illegal’ immigrants, who he famously said are ‘poisoning the blood of our country’. No wonder, the redrafting of the 2017 legacy Tax and Jobs Cut Act (TJCA) - curiously named One Big Beautiful Bill - had a whole chapter on ‘Removing Taxpayer Benefits for Illegal Immigrants’.

The bill seeks to, among other things, levy an excise tax of 3.5% on remittance transfers. Originally, the bill had envisaged a 5% tax on outward remittances, but later reduced to 3.5% through an amendment at the time of its passage in parliament. The new tax, which comes into effect from 1 January 2026, applies to green card holders or other individuals, who are on other non-immigrant visas in the US.

“By exempting only US citizens and nationals making remittance through qualified remittance transfer provider, the proposal disproportionately affects millions of lawful immigrants including green card holders, work visa holders, and non-resident aliens, many of whom maintain ongoing financial obligations in their home countries,” says Sandeep Jhunjhunwala, M&A Tax Partner at Nangia Andersen LLP.

The new levy is part of the Trump administration’s larger goal of cracking down on immigrants – illegal or otherwise. Trump has data ‘in his favour’ to back his anti-immigrant stance. Pew Research puts the US foreign-born population at 47.8 million in 2023, which is an increase of 1.6 million from the previous year. According to it, immigrants account for 14.3% of the US population, a roughly threefold increase from 4.7% in 1970.

Mexico is the top country of birth for US immigrants. In 2022, roughly 10.6 million immigrants living in the US were born there, making up 23% of all US immigrants. The next largest origin groups were those from India (6%), China (5%), the Philippines (4%) and El Salvador (3%).

Most immigrants (77%) are in the country legally. As of 2022, 49% were naturalised US citizens; 24% were lawful permanent residents, 4% legal temporary residents and 23% unauthorised immigrants.

It said that in the US labour force, the percentage rise in the foreign-born workers stood at 6.3% in 2022 from 0.7% in the pre-pandemic year of 2019; however, in the case of native-born workers the share largely remained unchanged at 1%.

The US is also the largest origin country for remittances in the world, with more than $656 billion sent overseas in 2023, according to World Bank data. According to a Financial Times report, Mexico is one of the largest beneficiaries of remittances sent from the US. Mexican immigrants sent $65 billion, or 4% of the GDP, back home in 2023 -- more than all foreign direct investment it received during the year.

According to an estimate by the Joint Committee on Taxation in the US, at 5% original levy, the country would have raised around $22 billion by 2034.

According to a report by Migration Policy Institute (MPI), a Washington DC-based think tank, the Indian diaspora comprises 5.2 million US residents who were either born in India or reported Indian ancestry or origin. Of these individuals, around 55% were born in India, and the remaining 45% were born in the United States or elsewhere.

India was the third largest country of origin for immigrants who obtained a green card in 2023, after Mexico and Cuba, says a tabulation by Migration Policy Institute (MPI). Of the nearly 1.2 million people receiving a green card that year, about 78,100 (7%) were from India.

The MPI further estimates that around 3,75,000 (or 3%) of the 11.3 million unauthorised immigrants in the US of mid-2022

were from India, making Indians the fifth largest among all unauthorised immigrants in the US.

The Indian Diaspora in the US, which is the 10th largest in the country, stands to get most adversely affected by the new remittance tax as India is one of the biggest recipients of inward remittances from the US.

About 78% Indian migrants in the US are employed in high earning sectors such as management, business, science, and arts occupations. Over 54 lakh Indians are living in the US and out of this, more than 33 lakh belong to Persons of Indian Origin (PIO) category, according to Statista.

India remained the top remittance recipient in 2024. India’s total remittance receipts stood at $137.7 billion during 2024 (on a calendar year basis), accounting for 3.5% of India’s GDP. The annual inward remittance of $138 billion is 70% higher than India’s gross FDI inflow in FY25. Therefore, strong inward remittance is a handy tool for the government of India to manage the Current Account Deficit (CAD), especially amid falling net FDI inflows (Net FDI inflows fell to $0.4 billion in FY25 from $10 billion in the previous year).

According to an RBI report, 28% of India’s total inward remittances came from the US – making it $38 billion of money sent to India. A back-of-the-envelope calculation suggests the 3.5% levy on remittance could add $1.33 billion of tax burden on NRIs sending money back to India.

However, the real impact is yet to be known. A finance ministry official this newspaper spoke to said the government is yet to make an impact analysis of the remittance tax.

According to RBI’s annual report, the average cost of sending remittances of $200 to India is estimated at 5.3% in the third quarter of 2024, below the global average of 6.6%. But this is going to change after 2025, thanks to the remittance tax.

The measure could place added financial pressure on Indian nationals working in the United States, says Amarpal Chadha, Tax Partner and Mobility Leader, EY India. “Many may be forced to re-evaluate their remittance patterns, including the amount and frequency of remittances for the purpose of maintenance of family or investment in India,” he says.

Aside from the cost of remittance, there are other questions that crop up for NRIs sending money to India in the post-remittance tax era. The compliance burden for NRIs sending money back home is going to increase manyfold.

According to Lloyd Pinto, Partner, US Tax - Grant Thornton Bharat, NRIs may already have paid taxes on their US income and hence this is an additional cost and they are unlikely to get any tax credits for the same. “This is proposed to go into effect from Jan 1, 2026 and we expect to see individuals plan significant remittances before this new tax kicks in,” he says.

Saurrav Sood, Practice Leader, International Tax & Transfer Pricing at SW India, says there is no clarity whether this remittance tax will be available as a credit to the person doing remittance.

“If one is a US citizen or national and pays the tax, then the person can claim a full refund as a refundable income tax credit, if the person has a valid Social Security Number on tax return and provides proof of tax paid,” he informs.

Sandeep Jhunjhunwala of Nangia Andersen LLP raises the question of lack of clarity on the aspect whether the exemption (from the levy) is available to all those who have valid social security number or only to US citizens.

In addition to personal remittances, the provision could also affect compensation practices. Many foreign nationals receive restricted stock units (RSUs) as part of their pay packages. According to Jhunjhunwala, when these RSUs vest and are sold, the sales proceeds are often transferred overseas to the home country, for personal use, family support, or investment.

“Under the proposed remittance tax, such transfers of post-tax proceeds could attract the excise levy, adding a layer of cost to already-taxed income. This provision risks diminishing the United States’ attractiveness as a destination for international talent and investment, while also raising diplomatic sensitivities and increasing compliance challenges for both individuals and employer enterprises,” he says.