PNB fraud: ED attaches over Rs 218-crore assets of Choksi, others

NEW DELHI: The Enforcement Directorate (ED) Wednesday seized assets worth over Rs 218 crore in the nearly Rs 13,000 crore loan fraud case probe, officials said.

They said three provisional orders under the Prevention of Money Laundering Act (PMLA) were issued by the central investigative agency's zonal office in Mumbai for attachment of the properties in India and abroad.

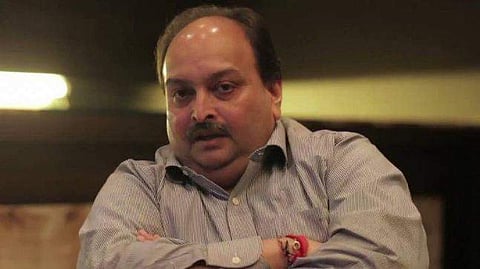

The beneficiaries of these assets put under attachment, they said, are absconding diamond jeweller Mehul Choksi, Mihir Bhansali, a close aide and US-based executive of main accused in the case Nirav Modi, and a company named A P Gems and Jewellery Park.

The total value of the attached and seized assets is Rs 218.46 crore, they said.

The ED is probing this case along with the CBI where it is alleged that Nirav Modi and Choksi defrauded the Brady House branch of the Punjab National Bank (PNB) in Mumbai to the tune of about USD 2 billion (over Rs 13,000 crore) in alleged connivance with officials.

While Choksi has been last reported to be in the Caribbean nation of Antigua and Barbuda, the Interpol (global police) has recently issued a red corner notice against Bhansali in this case.