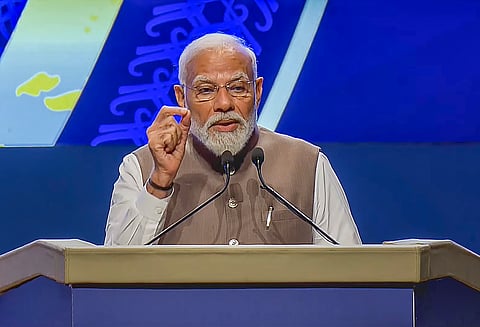

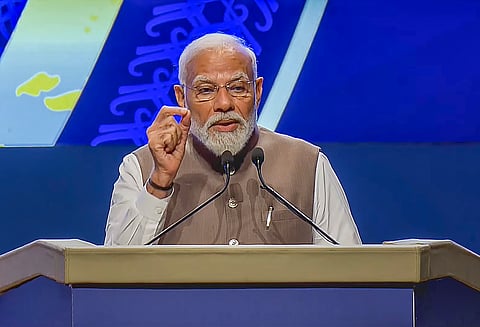

MUMBAI: Prime minister Narendra Modi today nudged the Reserve Bank to focus more on growth, given that it has done a commendable job in managing inflation and bringing about financial stability since the past decade.

Inaugurating the year-long celebrations of the 90th foundation day of the central bank (RBI was founded on April 1, 1935 as a joint stock company), Modi also called upon the financial sector to look at studying a “newer banking structure” given the evolving changes and demands in the financial industry landscape and also pitched for the RBI to take the country towards economic and financial self-sufficiency wherein it will be able to resiliently withstand any external challenges apart from leading the financial sectors of the Global South.

Lauding the monetary authority for the exemplary role it has been playing since May 2014, and especially during the pandemic and afterwards since the Russia-Ukraine war that spiked commodity prices and the resultant pains for an import-dependent economy like ours, he said the RBI has done a commendable role both managing inflation on one hand and boosting economic growth on the other, even as the global economy struggled.

Our GDP (gross domestic product) is going to report more records, he said and pointed out that it is contributing as much as 15 percent of the incremental global growth now.

He specifically spoke about how RBI has brought about financial stability and trust in the banking system that was plagued with bad loans when gross bad loans were over 11.25 percent which as of December 2023 was under 3 percent only.

Given that inflation is well under control (from near double-digits) the RBI can now focus more on growth, Modi said and specifically mentioned the governor Shaktikanata Das for his leadership in guiding the nation’s financial system to stability, resilience and trust.

Pitching for studying a newer banking structure to fund future needs of the economy, Modi said there may be a need for newer ways of "financing, operating and business models in the changing financial landscape, which calls for a new structure of banking.”

There are some challenges confronting the industry along with this, including artificial intelligence, block chain and machine learning which are changing the face of banking and cyber security amid the increasing reliance on digital banking and innovations such as fintechs, he said.

“In such a situation, we need to think about the changes which will be required in the country’s banking sector and its structure,” he told the audience, which included Tata Sons chairman N Chandrasekaran, Mukesh Ambani of the Reliance group, Mahindra Group chairman Anand Mahindra and some top bankers.