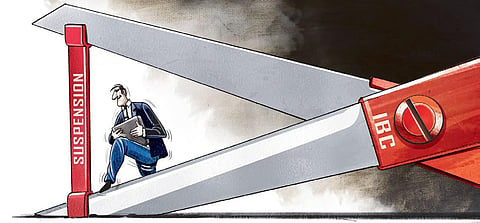

Does IBC provisions’ suspension provide intended succour?

To save companies from the insolvency process due to Covid-19, the Centre has proposed an Ordinance suspending Sections 7, 9 and 10 of the Insolvency and Bankruptcy Code, 2016 (IBC) for a minimum period of six months. This was preceded by increasing the insolvency initiation threshold to Rs 1 crore. The primary objective is to protect stressed MSMEs for defaults likely to occur as a result of Covid-19. These measures clearly show that the Centre has accorded primacy to the existence of companies over the resolution of their stressed assets.

This measure has been opposed as a move that defeats the object of IBC, especially Section 10, which permits a company to self-initiate the insolvency process that could help in immediate restructuring.

Resolution process under the IBC: While these apprehensions may be justified, it may not hold good when the IBC process is viewed from a vantage point.

The resolution process starts upon admission of an application under Section 7, 9 or 10 when the Corporate Insolvency Resolution Process (CIRP) of a corporate debtor is initiated. The Resolution Professional (RP) then takes control of the corporate debtor, including its assets. Subsequently, the RP invites claims from creditors—financial operational or otherwise—and constitutes the committee of creditors. Following this, the RP prepares an information memorandum and floats an expression of interest, which lays down the criteria for potential resolution applicants to take over the corporate debtor. The resolution plans formulated by the applicants are finalised by the Committee of Creditors (CoC). Upon approval by the CoC and the Adjudicating Authority, the successful resolution applicant takes over the corporate debtor.

In the event the resolution plan is not approved or the resolution process is not concluded within the maximum period of 270 days, the corporate debtor goes into liquidation. However, even under liquidation, the Hon’ble NCLAT in Y Shivaram Prasad v S Dhanapal & Ors, Company Appeal (AT) Insolvency No. 224 of 2018 remarked that efforts must be made to keep the company as a going concern. In the event of failure, the liquidator has to try and sell the business of the corporate debtor as a going concern.

The above shows that the resolution process necessarily involves a third party who pumps in funds to keep the company afloat. This presupposes that there are able and financially healthy companies, with a lucrative business, willing to take over the corporate debtor.In light of the present pandemic, it is difficult for corporates who would come forth with a resolution plan. With every company facing a financial crunch, and the demand in the market at an all-time low, corporations are looking to downsize their operations. The acquisition may not be on the cards for these corporations at any time in the near future.

Therefore, if these provisions are not suspended, it will be difficult to achieve any resolution process as there will be no resolution applicants, thus inevitably leading the company into liquidation.The numbers so far: According to the Insolvency and Bankruptcy Board of India’s quarterly newsletter for the months October to December, 2019, the financial creditors’ claims under the resolution plans were significantly low when compared to their admitted claims. Financial creditors were realising sums that were closer to the liquidation value of the corporate debtors as opposed to their admitted claims. To quote an example, in the CIRP of Ambey Iron Private Limited, the admitted claims of the financial creditors were Rs 218.55 crore and the liquidation value of the company was Rs 5.63 crore. The amounts realised by the financial creditors under the resolution plan were Rs 11.3 crore.

Therefore, statistics from the previous quarter shows that in light of the unprecedented Covid-19 situation, the realisable value would plummet further since no resolution applicant would be in a position to infuse funds to take over a stressed corporate debtor. Existence of company v. resolution of assets: CIRP processes that commenced prior to the pandemic and are currently at the stage of resolution are still hanging by a thread since the valuation of the companies would have dipped and bidders might reconsider before submitting their proposals. Hence, there is no guarantee that the corporate debtors would face a better resolution process if the provisions are allowed to be invoked.

Suspension of the aforesaid provisions of IBC would not be detrimental to creditors. On the contrary, the suspension will provide sufficient time and opportunity for the companies to recoup the losses incurred during the pandemic, thereby increasing their realisable value. Consequently, creditors will have a better realisable value. The breather provided would further have a positive effect on the performance of companies across various sectors. The proposed suspension, although temporary, does provide the intended succour to ensure the existence of companies affected by the Covid instigated financial slump.

The way forward, a proposal: It is necessary to ensure that no undue advantage of the proposed resolution is taken. Attempts to defeat the rights of creditors may be further protected by strengthening existing provisions under Sections 43, 44 and 66 by prescribing stricter penalties for any director/promoter indulging in preferential/fraudulent transactions. While the move to suspend invocation of IBC provisions is certainly a step in the right direction, it is also crucial to ensure that the Ordinance is coupled with other economic policies that boost the companies’ performance and provide greater liquidity to the firms.

(Sriram Venkatavaradan and Ramya Subramaniam are advocates practising at the Madras High Court)

(Email address:sriramv21@gmail.com)