The antitrust hearings against Big Tech—Amazon, Facebook, Google and Apple—ended last month in the US. We can expect to see a report by the sub-committee this month. The main question being asked is whether these companies have become too dominant for the good of customers, vendors and competitors. The best that the Big Four can hope to get away with is a rap on the knuckles. The worst-case scenario for them would be a recommendation to break up the companies as has happened with Standard Oil or AT&T in the past.

The US has a long history of antitrust investigations and actions. The first antitrust law in the US was the Sherman Act, which came into being in 1890. Since then, it has been bolstered by other laws such as the Federal Trade Commission Act and the Clayton Act. In 1969, India passed its own Monopolies and Restrictive Trade Practices (MRTP) Act. Indira Gandhi, who was the prime minister, was perhaps even more suspicious of businessmen than her father. The Act was meant to ensure that there was no concentration of economic power in private hands.

This was slightly ironic given that the government handed out licenses about what anyone could produce and in what quantities. Moreover, the government was also inclined to nationalise entire sectors and industries without much ado. Still, despite all the controls, the biggest business groups and the government played a cat and mouse game. Loopholes, lobbying and corruption ensured that some businessmen always managed to latch on to licences offered by the government. A report that came out just prior to the MRTP Act had suggested that about 75 business groups controlled over 50% of the economic activity allowed to the private sector.

The MRTP Act was not very effective despite it being amended several times. The MRTP Commission launched a great many investigations, but it rarely managed to punish any business house. Some of it had to do with the fact that the burden of proof was high and the commission did not have adequate resources. Other problems included the inability to penalise any business and the fact that any ruling would find its way to the courts.

It could be argued that the MRTP Act came into being in the wrong era. Though it was supposed to check market dominance, the government’s overarching influence on business matters through licensing ensured that any dominance was by design, not market forces. The economic reforms that started in 1991 removed many controls. Many sectors were opened up, foreign and domestic capital was allowed in a range of sectors, and industries and services that were earlier government monopolies started welcoming private players.

After a decade or so of reforms, it was felt that the MRTP Act was a relic of another era and there was no point in amending it further. A new Act was necessary for the new economic environment—and the Competition Act, 2002, was passed, which led to the formation of the Competition Commission of India (CCI). The MRTP continued for a few more years, before it was repealed in 2009. Because of the large number of players who raised capital and rushed into each sector, market dominance was not a great concern. While the CCI has investigated many cases of cartelisation and anti-competitive behaviour, and even imposed severe penalties, it did not have to deal with the complex issues that the US antitrust hearings have routinely faced.

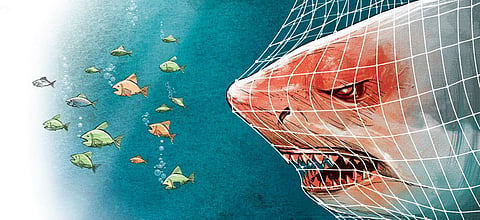

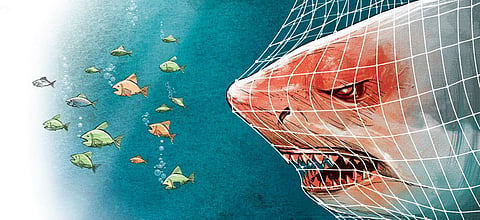

In the US for example, commissions have had to deal with more nuances than either the MRTPC or CCI. In the current case, Google and Facebook offer services for free to consumers. Amazon strives to offer the cheapest products. But Google, Facebook and Amazon also try to shut out smaller rivals by acquiring them or just drive them out of business because of their clout. This reduces competition and that has long-term implications. They also collect data from their consumers—and this data can be used to manipulate behaviour or dictate outcomes.

Why is this important for India? It is because three government policies/actions in the past half-a-dozen years and some decisions by the Supreme Court have been changing the structure of Indian markets, and now it is turn of the pandemic to do so. Demonetisation and GST were initiated explicitly to drive formalisation of the economy. One consequence of them was that bigger, better organised players gained at the cost of smaller ones with lesser resources. The Insolvency and Bankruptcy Code (IBC) was designed to solve the problem of non-performing assets (NPAs) of banks. But it has also led to a consolidation in many sectors. The Supreme Court’s decisions on telecom have resulted in just a few companies remaining in the sector.

The current pandemic is also playing a role. A handful of companies that have cash or can raise capital are taking over others that are struggling with debt servicing. In a number of sectors, three or four players have achieved overarching dominance. Telecom, organised retail, ports and airports are examples where two or three players control the bulk of the sector. Is the CCI up to the task? Lawmakers need to examine its provisions and efficacy in detail to see if it needs to be modified or not.

Prosenjit Datta

Senior business journalist

(prosaicview@gmail.com)