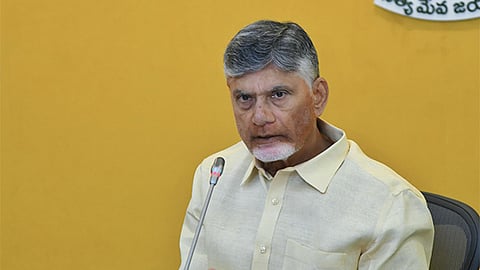

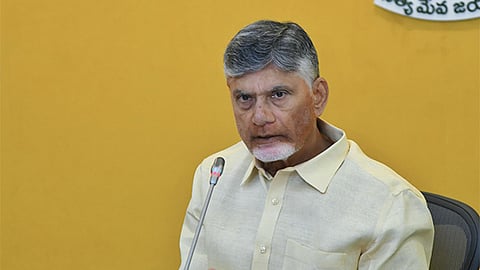

VIJAYAWADA: The 231st State-Level Bankers’ Committee (SLBC) meeting held under the Chairmanship of Chief Minister N Chandrababu Naidu at the State Secretariat on Tuesday unveiled an annual credit plan to the tune of Rs 6.60 lakh crore for 2025-26. This amounts to an increase of 22 percent, compared to the 2024-25 fiscal target.

A target of Rs 4.58 lakh crore has been fixed for the priority sector, including Rs 3.06 lakh crore for agriculture sector and Rs 1.28 lakh crore for MSME sector. Additionally, Rs 2.02 lakh crore has been earmarked for the non-priority sector.

Speaking on the occasion, the Chief Minister stated that Andhra Pradesh is undertaking massive initiatives over the next four years with a focus on development, wealth creation, and poverty eradication. As part of the Swarnandhra Vision-2047, the government is prioritising projects and goals to be completed by 2029, he said and urged banks to extend full support and exceed the targets set under the 2025-26 credit plan.

Speaking on the occasion, the Chief Minister stated that Andhra Pradesh is undertaking massive initiatives over the next four years, focusing on development, wealth creation, and poverty eradication.

As part of the Swarnandhra Vision-2047, the government is prioritizing projects and goals to be achieved by 2029.

He urged banks to extend full support and exceed the targets set under the 2025–26 credit plan.

Help promote economic growth: CM to bankers

After reviewing the achievements of FY 2024–25 with banking officials, the Chief Minister outlined the goals for 2025–26. He commended bankers for surpassing 100% of last year’s targets, placing Andhra Pradesh at the forefront in South India. He emphasized that bankers should consider how they can contribute to the growth of DWCRA women, tenant farmers, SCs, STs, BCs, and minorities.

Naidu stressed that bank support is essential for the growth of all sectors in line with rising demand. Massive projects are underway across different sectors, and financial assistance is critical. He highlighted the government’s initiative to promote MSMEs and establish Ratan Tata Innovation Hubs in every constituency under the vision of “One Entrepreneur per Household.” He also reiterated the government’s Zero Poverty–P4 initiative aimed at eliminating poverty and reducing inequality by 2029.

The Chief Minister noted that Visakhapatnam is making remarkable progress economically and industrially, while Amaravati is being positioned as a hub of future opportunities. He added that Rayalaseema is being developed as a horticulture hub and a centre for electronics manufacturing.

For FY 2024–25, the credit plan target was Rs 5.4 lakh crore, while banks disbursed Rs 6.83 lakh crore—127% of the target. Of this, Rs 4.14 lakh crore was directed to the priority sector, and Rs 2.68 lakh crore to the non-priority sector.

In the agriculture sector, the target was Rs 2.64 lakh crore, but disbursements reached Rs 3.07 lakh crore—116% of the target. Of this amount, Rs 1.69 lakh crore was disbursed during the Kharif season and Rs 1.37 lakh crore during the Rabi season.

The MSME sector, a high priority for the state, saw disbursements of Rs 95,620 crore against a target of Rs 87,000 crore—110% achievement. This included Rs 49,552 crore for micro enterprises, Rs 27,632 crore for small enterprises, Rs 18,138 crore for medium enterprises, and Rs 298 crore for other segments.

Finance Minister Pyyavula Keshav questioned bankers about the declining year-on-year growth rate in credit plan implementation. While the growth was 133% in 2021–22, 163% in 2022–23, and 138% in 2023–24, it dropped to 127% in 2024–25 and sought an explanation for this trend.

The MSME sector, which is a high priority for the state, saw disbursements of Rs 95,620 crore against a target of Rs 87,000 crore-110% achievement. This includes Rs 49,552 crore for micro enterprises, Rs 27,632 crore for small enterprises, Rs 18,138 crore for medium enterprises, and Rs . 298 crore for other segments.

Finance Minister Pyyavula Keshav questioned bankers on the declining year-on-year growth rate in credit plan implementation. While growth was 133% in 2021-22, 163% in 2022-23, and 138% in 2023-24, it dropped to 127% in 2024-25, he pointed out.