South India logs Rs 20K crore in 2025 residential properties' sales

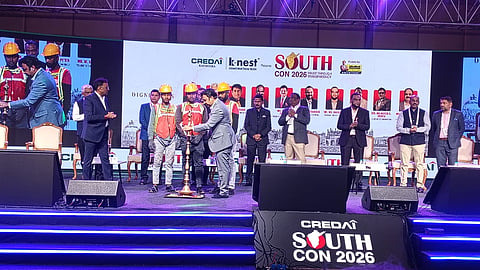

BENGALURU: South India’s real estate market recorded an estimated Rs 20,000 crore in sales of residential properties in 2025, marking a significant post-pandemic recovery and highlighting the rising importance of Tier-2 and Tier-3 cities, said MR Jaishankar, Chairman & Managing Director, Brigade Group, at the CREDAI SouthCon 2026 in Bengaluru.

He said that while South India lags behind the North and West in absolute market scale, emerging cities like Coimbatore, Kochi, Thiruvananthapuram and Visakhapatnam are becoming the region’s primary growth engines. Commercial real estate also surpassed projections, with absorption of 2–4 million sqft office space, 4–8 million sqft retail, 8–12 million sqft warehousing, 5,000–8,000 hotel rooms, and 10–30 MW data centre capacity in 2025.

Jaishankar forecasted substantial growth by 2030 and 2035, including up to 60,000 residential units in Tier-2 and Tier-3 cities, 30–40 million sqft retail, 90–120 million sqft warehousing, and up to 900 MW data centre capacity. He attributed the expansion to India’s ambitious infrastructure projects like Bharat Mala, Vande Bharat corridors, national highways, and the Udaan airport network, which has grown from under 10 to 65+ airports.

The conclave highlighted that warehousing, hospitality, and data centres are now expanding faster than traditional office and retail spaces.

CREDAI state presidents Bhaskar T Nagendrappa (CREDAI Karnataka), K Indrasena Reddy (CREDAI Telangana), Bayana Srinivas Rao (CREDAI Andhra Pradesh), Roy Peter (CREDAI Kerala) and W S Habib (CREDAI Tamil Nadu) shared that housing demand remains strong, but affordability challenges persist due to rising construction and land costs.