THIRUVANANTHAPURAM: Kerala has come out against the Union government's proposed amendment to section 6 of the Income Tax Act, saying it would affect its economy which is supported largely by remittances from NRKs in the Gulf.

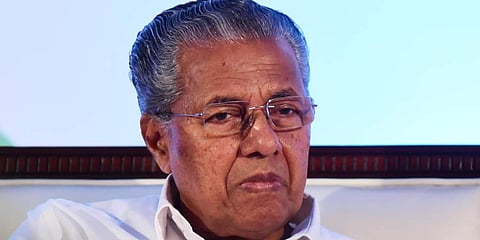

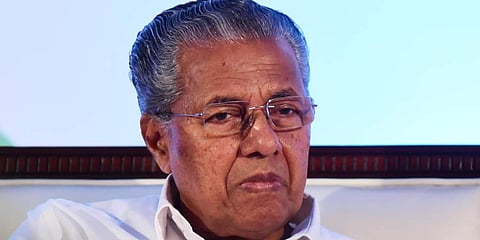

In a statement here, Chief Minister Pinarayi Vijayan said the state's economy, which is substantially supported by remittances, especially from those in the Gulf countries, would be affected by this amendment.

In the Finance Bill presented along with the Union budget 2020, the Centre has proposed to amend section 6 of the Income Tax Act, 1961 which stipulates conditions for determining residential status for tax purposes in India.

Presently, Indian citizens or people of Indian origin are treated as residents if they stay for 182 days or more in India.

The amendment proposes to reduce this to 120 days with effect from April 1, 2021.

For a resident, his or her global income is subject to tax in India.

Though the Explanatory Memorandum to the Finance Bill states that this is a provision to check tax abuse, it needs to be pointed out that a large number of persons who do not fall even remotely in the category of tax evaders, would be put to great hardship due to this proposed amendment, the statement quoted Vijayan as saying.

Most of the people working in the Middle East were from Kerala and they have houses and families in the state and they visit and stay in their home state to look after domestic affairs.

"Tax evasion is not their intention and they do not fall in the category of persons who shift their bases to avoid taxes," he said.

Persons from Kerala working in the Middle East and doing medium-scale businesses there have the responsibility of taking care of their families who are here.

Such persons would be "hard hit" by the amendment, the statement said.

"We record our strong disagreement with the move in the Finance Bill, 2020, brought in under the guise of checking tax abuse, but is, in reality, going to hurt those who toil and bring foreign exchange to the country," Vijayan said adding the central government should desist from going ahead with the amendment.

ALSO READ: 2020 Budget leaves the economy wondering

There was no dispute that the undisclosed income of those who transfer money to tax havens should be brought within the tax net and such proceeds should be utilised for social welfare programmes, he said.

But persons working in countries of the Gulf region which have no personal income tax would be hit.

Most of such persons are not in the economic upper crust.

"They need to be excluded from the ambit of the proposed amendment as they are mostly middle-income people who bring to our country a part of their hard-earned income", he said.