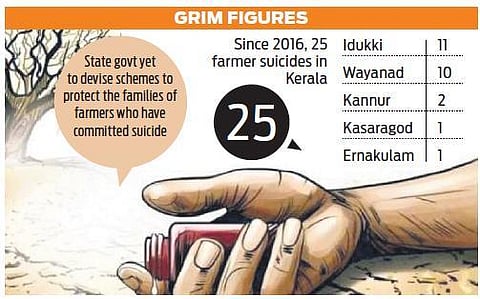

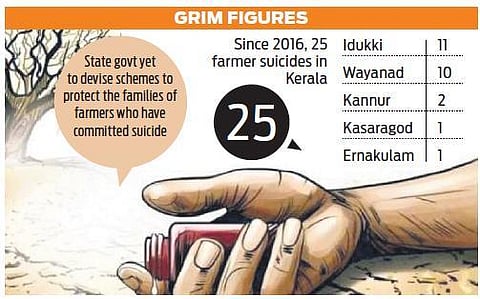

THIRUVANANTHAPURAM: Although the state has set a model by fixing floor price for rubber, coconut, paddy and Wayanadan coffee beans in order to insulate farmers from the perils of market fluctuation, the state has witnessed as many as 25 farmer suicides since 2016. The farmer suicides due to debt and bankruptcy were one in 2015 and five in 2014 in the state, according to the stats available with the National Crime Records Bureau.

According to a written reply submitted in the Assembly by Agriculture Minister V S SunilKumar, of the 25 farmer suicides during the LDF government’s term, 11 were in Idukki and 10 in Wayanad followed by Kannur with two and Kasaragod and Ernakulam by one each.

Of these, 12 took the extreme step in 2019 in the aftermath of the mid-August floods of 2018. The minister said that suicides were the result of damage caused by 2018-19 floods to properties and crops, failure to repay bank loans on time, and the subsequent threat of recovery measures.

Stating that the state government has no proposal to devise schemes to protect the families of farmers who committed suicides, the minister said the department has devised a slew of schemes, including crop insurance and benefits, for restoring the flood-hit agriculture sector.

P Indira Devi, agri-economist and former director of research, Kerala Agriculture University, said: “Despite high banking density and literacy, non-banking institutions are playing a major role in providing farm loans in Kerala. A comprehensive study conducted by National Sample Survey Organisation in 2013 on the agriculture scenario in the state has revealed that 78 per cent of the agriculture households in Kerala are reported to be in debt while the average outstanding loan of each agriculture-household is Rs 2.13 lakh. Of this, 20 per cent of farm credit is from non-banking institutions. This was the last comprehensive study on farmer suicides held in Kerala.”

“In majority of the cases, farmers took the extreme step unable to withstand social pressure,” she said, adding there were isolated instances like farmers making use of farm loans for non-agriculture purposes. According to agriculture experts, though lead banks provide agriculture gold loans to their consumers, 99% of gold loan beneficiaries are non-farmers.

Even some of the loan sharks make use of agri-gold loans by pledging the gold they collected as surety and availing the loan meant for farmers, in nationalised banks to get the benefit of interest subvention and infuse the money into the market at exorbitant interest rates, they said.