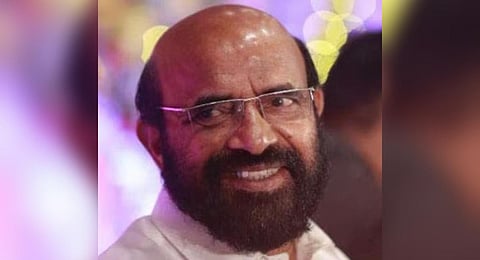

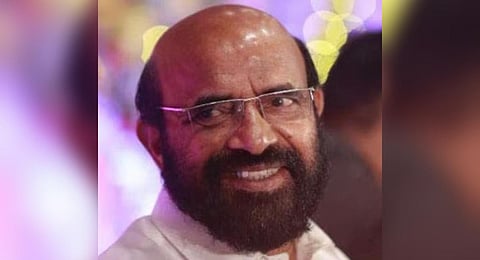

KOCHI: The Enforcement Directorate (ED), probing money laundering in the Kandala Service Cooperative Bank has found that former bank president and expelled CPI leader N Bhasurangan and family had deposits worth Rs 4.8 crore in the bank. Besides, loans were issued in the name of benamis and they have now run up dues to the tune of Rs 51 crore.

Bhasurangan and his son Akhiljith, arrested recently, are in ED custody till Friday. Having analysed the bank statements of Bhasurangan and his family, ED found they held five accounts at the Kandala bank alone. Bhasurangan was the president of the bank for 30 years. He has two accounts in the bank with a total deposit of Rs 1.04 crore. his son Akhiljith has Rs 1.5 crore as deposit while wife Jayakumari and daughter Abhima have deposits of Rs 42.87 lakh and Rs 78.63 lakh, respectively. ED revealed the details of the accounts in a report filed at the Prevention of Money Laundering Act Court in Kochi.

According to ED, Bhasurangan had opened various bank accounts in the name of his benamis, like Sreejith and Ajith Kumar, and more than Rs 51 crore is overdue under various segments given as loans.

“Bhasurangan, in his statement, admitted that his family members and relatives had availed various loans worth Rs 1.87 crore by mortgaging and re-mortgaging the same properties. However, as per the statement of Baiju Rajan, the secretary of the Kandala bank, the total loans availed by his family members and relatives is Rs 2.36 crore, excluding interest,” the ED report stated.

In his statement, Akhiljith claimed he has a total liability of Rs 65.75 lakh. However, the Kandala bank authorities told ED that he has availed Rs 71.50 lakh loan. According to him, his annual income is Rs 10 lakh generated from various businesses. He invested in the entities BRM traders, BRM Supermarkets, Cafe B Cips, and Multi Cuisine Restaurants. It is also learnt that he owned a 2019-model Mercedez Benz GLA worth Rs 42 lakh. He is also managing a partnership in Malavika Enterprises, where his father and father-in-law have investments.

ED also maintain that, on the direction of Bhasurangan, monthly deposit scheme (MDS) accounts were converted to monthly deposit loan (MDL) accounts to show the bank in good financial health, as revealed to the central agency by Kandala bank secretary Baiju Rajan.