KOCHI: In the early 1990s, when the Murukkumpuzha Cooperative Bank in Thiruvananthapuram faced irregularities amounting to `3 crore, a big amount, Cooperation Minister M V Raghavan immediately appointed the district bank officer as the bank’s secretary and advanced money from the District Cooperative Bank (DCB), nipping the crisis in the bud.

“When the Murukkumpuzha bank started paying, it restored depositors’ confidence in the bank, and they stopped withdrawing funds,” recalls CMP leader C P John, who is closely associated with the state’s cooperative sector.

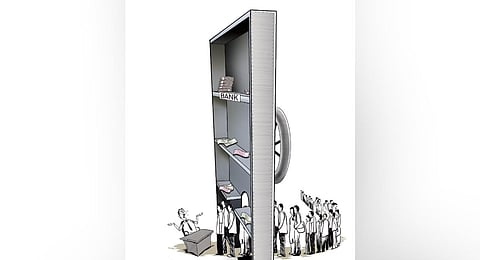

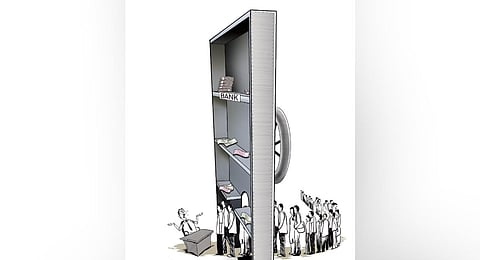

As the sector feels the heat from the Karuvannur bank scam, John reckons that the merger of 14 DCBs with the Kerala State Cooperative Bank (KSCB), now Kerala Bank, has become the biggest stumbling block in resolving the issue. This is because the bank comes under the direct purview of the RBI, and not a single paise can be advanced to cooperative banks without the central bank’s nod.

“DCBs were considered central banks. Around 350 out of 766 districts in the country have DCBs. And ours are considered the best among the lot,” he says.

Furthermore, Ernakulam, Thiruvananthapuram, Kannur, and Thrissur DCBs had a deposit base of more than Rs 10,000 crore.

“The DCBs were troubleshooters, investors, and big employers in Kerala. Above all, they were the apex bank for nearly 16,000 cooperative societies in Kerala. Now, the Kerala Bank’s hands are tied,” John says.

Kerala Bank president Gopi Kottamurickal begs to differ.

“There is nothing forbidding us from supporting Karuvannur bank,” he says but adds that it can provide funds only as per the guidelines of the RBI and Nabard (National Bank for Agricultural and Rural Development). Kerala is one of the few states where credit cooperatives continue to be an important source of credit, particularly rural credit. About 33% of the total household debt in Kerala was raised from credit cooperatives in 2018; the corresponding share was just 8% nationally, underscoring the importance of cooperative credit in Kerala compared to other states, according to a Planning Board report of 2022.

S Jayasooryan, a BJP member and former vice president of Meenachil Service Cooperative Bank in Kottayam, said the big flouting of the rule happened when the cooperative societies started to name themselves as ‘banks’.

“In reality, these are cooperative service societies. But they not only named themselves as banks but also started to get into other banking areas such as hire-purchase loans and other lending means,” he says.

Secondly, these cooperative societies used funding from Nabard, which is strictly for farmers at 4% interest rates, and diverted the money into other sectors at 14%, in the process taking a margin of 10%, explains Jayasooryan. The solution for cleaning up the state’s cooperative sector is to make KYC (know your customer) mandatory and link the accounts to Aadhaar, says Jayasooryan.

M M Monayi, former MLA and ex-chairman of Ernakulam DCB, says ‘over-politicisation’ and a lack of expertise in thoroughly auditing the accounts of cooperative banks regularly are the root causes of the problems. Kerala has 1,675 service cooperative banks, and they are an important source of credit for the rural populace, he says. “These are a marginalised section of people who do not have a CIBIL score or credit history, now a basic requirement to get a loan from a scheduled commercial bank. These primary cooperative banks or urban cooperative banks play a role akin to that of the Grameen Bank in Bangladesh, which is providing credit to the poor and marginalised,” explains Monayi.

Kottamurickal alleges the scaremongering by a certain section is aimed at helping private banks and boosting the BJP-led Centre’s bid to promote multi-state cooperative societies. In recent years, commercial banks have eaten up the share of cooperatives in household debt and credit in Kerala. Between 2012 and 2018, the share of credit cooperatives in the state’s total household debt declined from 41% to 33%.

This decline was largely taken up by commercial banks and RRBs (Regional Rural Banks), whose combined share increased from 35% to 45% during the period, according to the Planning Board study. Secondly, the share of credit cooperatives in total agricultural credit in Kerala has been on a steady decline. In 2019–20, credit cooperatives provided about 16% of total agricultural credit flow in the state, much lower than 21% in 2012–13. Monayi points out that in the state’s cooperative sector, there is no separation of powers, and the cooperation department controls everything. “And they undertake the audit though they are not competent to do it,” he says.

Jayasooryan points out that auditing in public and private banks is undertaken by external auditors, who are reputed chartered accountants. “The auditing in the cooperative sector is done by the internal auditors of the cooperation department. Simply put, the politicians are auditing the cooperative banks controlled by politicians,” he says, adding that the auditing of Kerala’s cooperative banks has been delayed by three years.

Kerala’s cooperative banking sector is around Rs 1.2 lakh crore. The sector, which is the lifeline of the rural and semi-urban economies, has been losing ground over the years, thanks to a host of issues, including mismanagement, overpoliticization, and recurring fraud. Every crisis is an opportunity, and the ongoings at Karuvannur Bank may be just what the doctor ordered.

figures that matter

33%

Is the total household debt in Kerala raised from credit cooperatives All-India: 8%

Between 2012 and 2018, share of credit cooperatives in total household debt in Kerala declined from 41% to 33%

Decline largely taken up by commercial banks and RRBs, whose combined share increased from 35% to 45% in the same period

In 2019-20, credit cooperatives provided about 16% total agricultural credit flow in Kerala, much lower than 21% in 2012-13

Cooperatives are the lifeline of Kerala’s rural economy. However, the sector faces a crisis of confidence after irregularities at Karuvannur bank triggered concerns over the health of hundreds of other credit cooperative societies. TNIE digs deeper into the issue to find out what the root causes of the crisis are