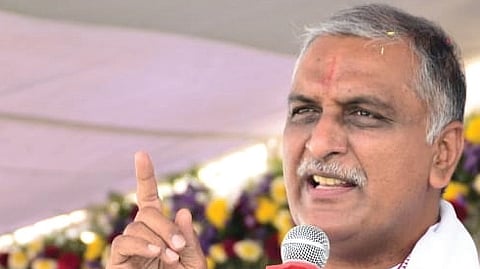

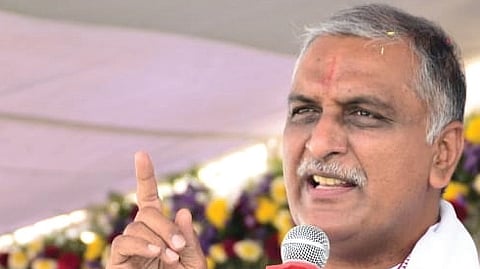

HYDERABAD: Alleging “serious irregularities and possible violation of SEBI rules” by the Telangana State Industrial Infrastructure Corporation (TGIIC), BRS MLA and former minister T Harish Rao on Thursday asked the Securities and Exchange Board of India to initiate appropriate action against the corporation under the provisions of SEBI Act, 1992 and allied regulations.

Harish also wanted SEBI to investigate the process of land mortgage and loan/NCD issuance by TGIIC.

In a letter to SEBI chairman, the former minister expressed concerns about regulatory breach, misrepresentation and lack of transparency by the TGIIC, which deserve SEBI’s immediate scrutiny and intervention in the public and investor interest.

“The government of Telangana has sold 400 acres of land at 75 crore per acre. The TGIIC mortgaged 400 acres of land in the Kancha Gachibowli area to raise loans via non-convertible debentures (NCDs) or through merchant bankers and financial intermediaries. However, a Supreme Court-appointed Empowered Committee has already identified this land as forest-like, potentially protected under environmental and conservation laws. The Supreme Court slammed the Telangana government for deforestation in the Kancha Gachibowli area in Hyderabad and stated that the state should either restore greenery or be prepared to send its officers to jail. Using such land as collateral may amount to material misrepresentation or fraudulent omission of facts if such status was not disclosed to lenders or potential investors,” Harish said.

The BRS leader said that the compliance concerns are: Regulation 4(2)(k) of the SEBI (Prohibition of Fraudulent and Unfair Trade Practices) Regulations, 2003, misleading representation or omission of material facts, Regulation 29 of the SEBI (Issue and Listing of Non-Convertible Securities) Regulations, 2021, false or misleading statements in offer documents and Section 11(2)(i) of the SEBI Act, 1992, empowering SEBI to prohibit deceptive practices in the securities market.

Harish said that it was also reported that TGIIC’s annual turnover is less than Rs 150 crore, yet the corporation has raised or is attempting to raise substantial loan amounts running into hundreds or thousands of crores, he said. “This calls into question the corporation’s repayment capacity, raising concerns over its financial soundness and possible risk of default, which could mislead lenders or investors unless transparently disclosed,” Harish said in his letter.

Non-disclosure of critical financial limitations

Non-disclosure or under-disclosure of such critical financial limitations could violate Regulation 23 — due diligence by merchant bankers, Regulation 4(2)(e) of the SEBI (LODR) Regulations, 2015 — fair and adequate disclosure to investors, Sections 15A and 15HA of the SEBI Act — penalties for failure to furnish accurate information and for fraudulent trade practices, he said

Harish also recalled that Telangana converted TGIIC from a private limited company into a public limited company.

“This structural change raises questions as to: whether due process was followed under Section 13 and 14 of the Companies Act, 2013; whether minority stakeholders (if any) were protected; whether SEBI was duly informed of such change, whether this conversion was done with the intention to issue securities or NCDs to the public or institutions, thereby invoking SEBI jurisdiction,” he pointed out.

“If such conversion was made without adequate disclosure or transparency, it may violate SEBI (Listing Obligations and Disclosure Requirements) Regulations, 2015, especially Regulation 30-Disclosure of material events and SEBI (Issue and Listing of Non-Convertible Securities) Regulations, 2021, if the company was used to issue debt instruments without proper vetting or compliance,” he added.

The BRS leader also stated that there were credible concerns that private institutions which acted as merchant bankers were paid a huge sum of money — Rs 169.83 crore plus 18% GST — in structuring these transactions, including the pledging of sensitive land assets, raising further alarm regarding the role of intermediaries and adequacy of due diligence, which amounts to breach of fiduciary responsibility.